Preserving your capital is one of the key concepts of investing. Without your capital, you cannot invest. Yes, some stop-losses can cause you to whipsaw in and out of a trading plan, but prudent investors would rather be stopped out for a 10% gain or loss for example than be sitting on a 50% loss. Stop-losses, if done correctly, can be setup in such a way that you minimise your trades and maximise your profits. There can be an optimal balance struck on the stop loss applied based on the types of shares you are purchasing.

Let’s take the example of some well-known ASX200 shares:

ALL, AMP, BHP, CBA, CTD, RCR, RFG, SIG, TLS, WOR

Let’s assume we bought these 10 shares on 2 January 2018 and are holding these shares as of 31 August 2018, having applied a buy and hold strategy. For this exercise I have assumed a 25,000 investment, that being 2,500 per share on average. As a result, you would be sitting on a loss just on 11% (before any dividends and franking credits). Accounting for dividends and franking credits, your returns would still note a negative return.

Click on image to enlarge

The daily journey since the start of the year to 31 August:

Click on image to enlarge

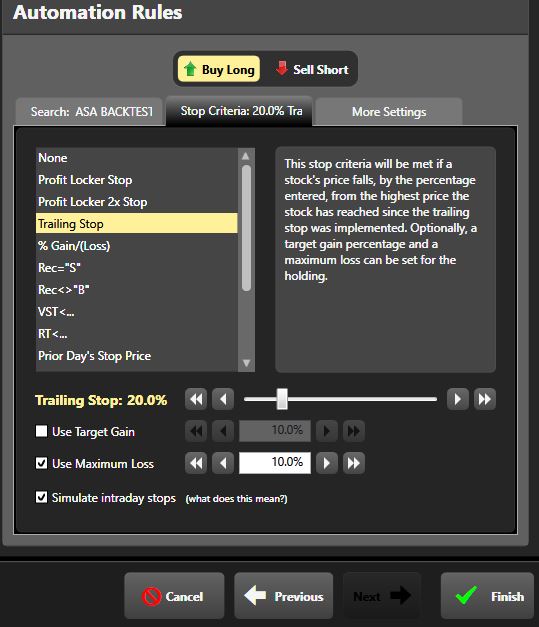

Now what if you applied stop losses to these 10 shares whereby you let the winners run and parted ways with the falling shares? The next step is to establish a stop loss. For this exercise let’s apply a 20% trailing stop loss and set the maximum loss allowed to be 10%. Once the stop loss is triggered then sell out the next day, giving plenty of time to react to the stop loss. Running the analysis again from the start of 2018 though to 31 August, the returns are just over 9% (before franking credits and dividends). However, since the shares that were stopped out were not replaced the franking credits and dividends are lower as a result. As of 31 August 2018, only 4 of the original 10 stocks purchased remain, that being: CTD, WOR, ALL and BHP. The total returns all up including capital gains, dividends and franking credits was just over 12% in total.

Click on image to enlarge

Would you have preferred option 1, where you simply applied a buy and hold strategy where your portfolio was down just under 11% but with a fully grossed dividend payout of 3.9% in the hand? Or what about strategy 2 which would have entailed 6 shares being stopped out with the portfolio up 7.3% and just on 2.7% in fully grossed up dividends in the hand? Sadly, some investors would have preferred option 1 since the dividends and franking credits are what they are after and do not want the inconvenience of having to sell out of shares let alone considering new shares to purchase.

I would prefer option 2. Sure, only 4 of the 10 stocks originally purchased were currently being held by 31 August which resulted in lower full grossed up dividends being paid out. However, the portfolio for option 2 is up 7.3% in capital gains. I could lock in a further 7.3% portfolio gains to add to my 2.7% grossed up dividends! Furthermore, there is never any harm in having cash on hand from the 6 stopped stocks ready to deploy into another opportunity. I couldn’t take any further returns on option 1 since I was sitting on a loss!

Whether you take income from franking credits and dividends or via portfolio profits or from both, it should make little difference at the end of the day, money is money. There may be a little bit more paperwork at tax time and possibly a little more tax because of option 2, but with significantly better return in my back pocket, I am a happy investor.

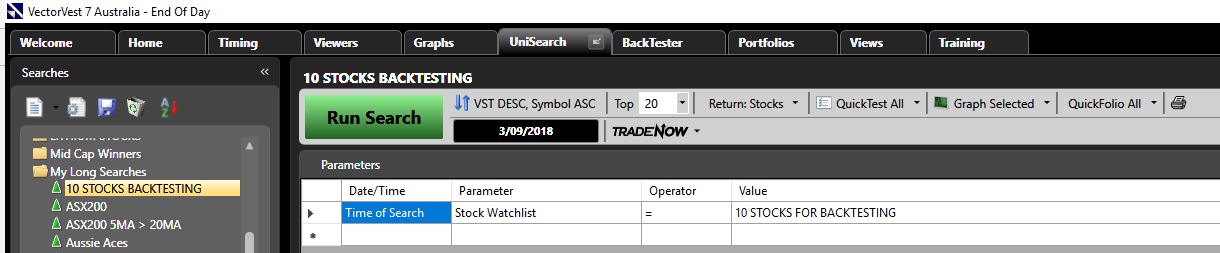

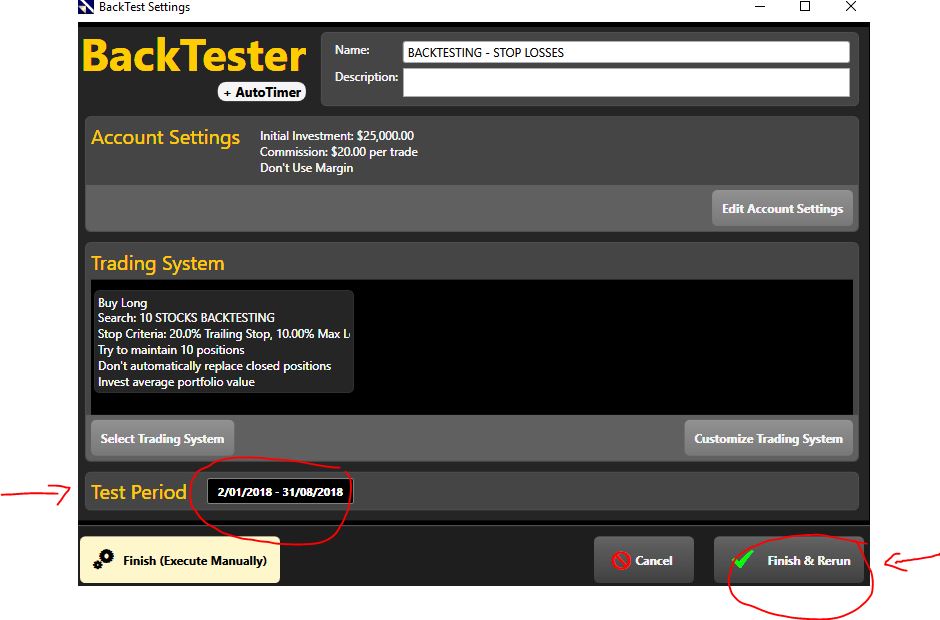

One last note: Was there any significance to having applied a 20% Trailing stop loss with a 10% maximum loss cap? Yes, this was calculated using the BackTester tool in VectorVest. BackTesting allows for us to optimise our portfolios. Having taken the 10 stocks, I put them into a watchlist. I then wrote a UniSearch whereby all I did was tell the UniSearch to look at the 10 Stocks only. From here I could then test the 10 stocks based on various stop losses to optimise the stop loss rules.

In the next blog post, I am going to take those 10 stocks and this time in addition to stop losses, I am going to apply risk money management and market timing rules to triple those returns! Stay tuned for the next blog post!

How to setup the BackTest:

Step 1: Setup a Watchlist and save the Watchlist:

Click on image to enlarge

Step 2: Setup a UniSearch:

Click on image to enlarge

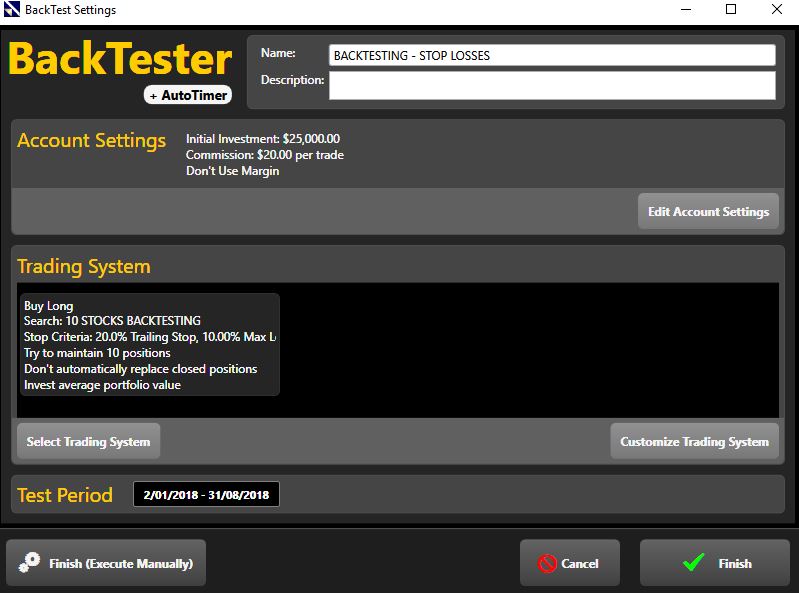

Step 3: Setup your BackTest:

Name your portfolio. Lave the account settings per the default for this exercise, so no need to change the account settings unless of course you want to.

Click on image to enlarge

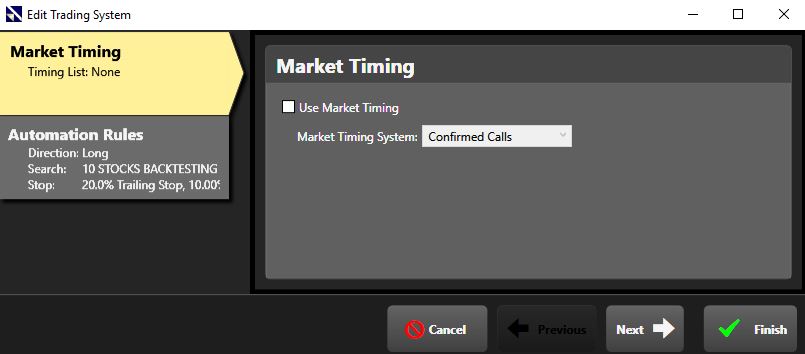

Untick the User Market Timing – we always want to use Market timing! However, for this exercise we are looking at a buy and hold strategy with stop losses and no market timing for demonstration purposes

Click on image to enlarge

Setup your stop losses as follows under the Stop Criteria Tab:

Click on image to enlarge

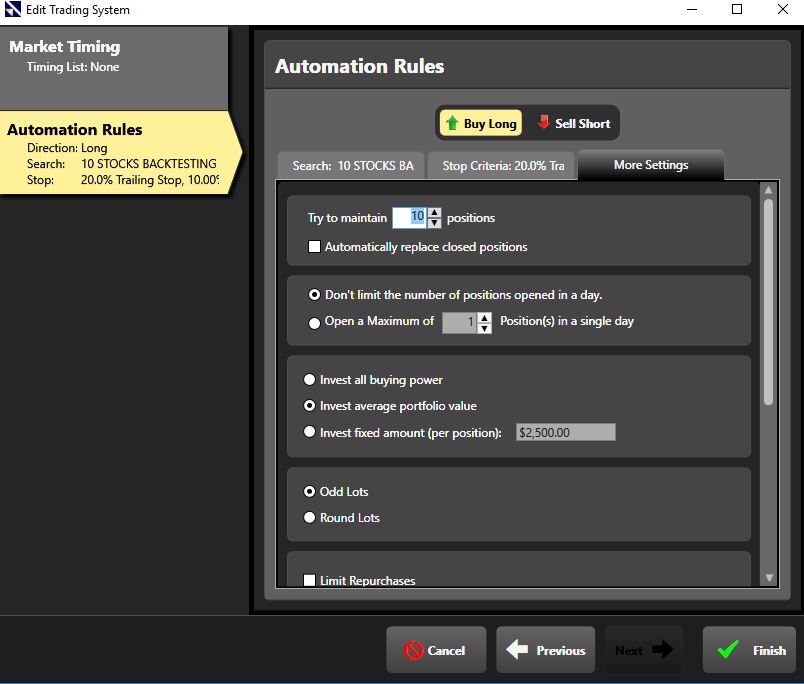

Setup your settings per below under the More Settings:

Once this is all setup, set the date to run from 3 January 2018 through to 31 August 2018

Have a go at editing the stop losses to see if you can improve the returns further.

Leave A Comment