Discover World-Class

Stock Analysis & Market Guidance

VectorVest tells you when to buy, what to buy,

and when to sell. It’s that simple.

Answers to all your investing questions.

- What stocks should you buy?

- Is now a good time to buy?

- When should you consider taking profits?

Direct & definitive answers at a glance or through your own analysis of VectorVest’s powerful database and charting tools.

New users can join for ONLY $9.95 USD – Risk Free 30-Day Trial!

100% satisfaction guarantee or your money back.

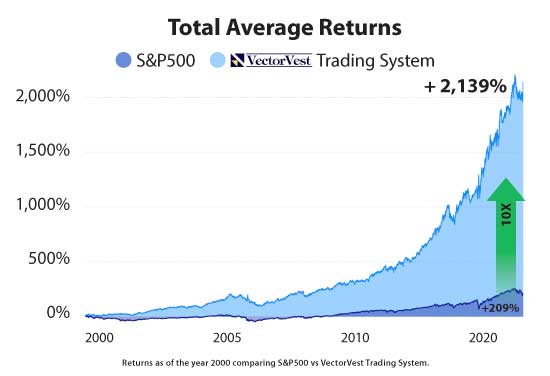

Bull & Bear Market Beating Returns

VectorVest has outperformed

the S&P 500 by 10x over 22 years!

How have we accomplished such an impressive feat? Simple. While others are buying and holding, we believe different markets require different investment strategies. During bull runs we recommend stocks with consistent and predictable earnings growth. During bear markets we advocate moving to cash or taking short positions.

Best part is we tell you when and how to do it all!

It’s easier than you think.

VectorVest is the only service that gives you information going back to 1995, so you can test and verify its amazing performance.

Multiply Your Net Worth While

Assuming Low Risk.

The idea of high risk, high reward never sat well with us. So we set out to find a proven method of returning high returns with low risk. The result is VectorVest’s methodology of buying high quality stocks with predictable earnings growth in rising markets. Sounds obvious but it can be difficult to find the very best opportunity. We make it simple with our top stock picks.

Looks like investing in quality stocks pays off.

| Stock | Return | Return on $1,000 |

|---|---|---|

| Sherwin Will. | 4,329% | $44,290 |

| Apple | 65,813% | $659,130 |

| AutoZone | 8,160% | $82,600 |

| NVIDIA | 51,702% | $518,020 |

| Amazon | 13,545% | $136,450 |

| Netflix | 25,419% | $255,190 |

| Monster Bev. | 85,082% | $851,820 |

A Revolutionary System to Picking Stocks

All of VectorVest’s stock picks are based on mathematical modeling that has identified what causes a stock’s price to rise or fall. The result is a system for stock market trend analysis using value, safety and timing (VST) to create clear buy, sell and hold signals that direct investors to rising stocks, in rising sectors and markets.

Value: Anything above 1.00 is worth looking at. Anything below 1.00 is a red flag. Stocks with ratings higher than 1.00 have above average appreciation potential.

Safety: Tells you how stable a stock is compared to other investments. Again, if the stock is above 1.00, it’s safer and more predictable than other stocks. If it’s risky and unpredictable, the rating will be below 1.00.

Timing: How does the short-term price performance look? Above 1.00 is good, below 1.00 is risky.

This methodology allows you to get in on stocks before they become household names.

The NASDAQ rose 400% in 5 years only to fall 78% from it’s peak by October 2002, giving up its meteoric gains during its biggest rally.

VectorVest market timing warned subscribers to get out of the market 3/20/20 to lock in these gains.

VectorVest market timing outperformed buy & hold strategies by more than 226%!

The bursting of the housing bubble culminated in a perfect storm that erased over 10 years of market gains. Something no one saw coming, but a trend that VectorVest saw developing.

VectorVest advised investors move to cash 11/02/07 or begin shorting the market allowing subscribers to rack up 19% gains by mid-summer of 08’ in the midst of a recession.

The Coronavirus Crash wiped nearly 11,000 points off the Dow, or 37%! While these events could not be foreseen, VectorVest had advised investors to tighten stops and take profits on 02/21/20.

On 3/25/20 VectorVest identified upward momentum and advised investors to buy stocks long, setting subscribers up for one of the fastest market recoveries in history.

The highest inflation in 40 years and rising interest rates spurred a Wall Street sell off. However, VectorVest subscribers were advised to go to cash on 11/22/21, leaving them unaffected by the downturn.

Further, those that took advantage of VectorVest’s shorting strategies saw gains as high as 93% in just 6 months!

The Unfair Advantage

25 Years of Successfully Identifying Market Turning Points

The NASDAQ rose 400% in 5 years only to fall 78% from it’s peak by October 2002, giving up its meteoric gains during its biggest rally.

VectorVest market timing warned subscribers to get out of the market 3/20/20 to lock in these gains.

VectorVest market timing outperformed buy & hold strategies by more than 226%!

Global Financial Crisis 2008

The bursting of the housing bubble culminated in a perfect storm that erased over 10 years of market gains. Something no one saw coming, but a trend that VectorVest saw developing.

VectorVest advised investors move to cash 11/02/07 or begin shorting the market allowing subscribers to rack up 19% gains by mid-summer of 08’ in the midst of a recession.

The Coronavirus Crash wiped nearly 11,000 points off the Dow, or 37%! While these events could not be foreseen, VectorVest had advised investors to tighten stops and take profits on 02/21/20.

On 3/25/20 VectorVest identified upward momentum and advised investors to buy stocks long, setting subscribers up for one of the fastest market recoveries in history.

The highest inflation in 40 years and rising interest rates spurred a Wall Street sell off. However, VectorVest subscribers were advised to go to cash on 11/22/21, leaving them unaffected by the downturn.

Further, those that took advantage of VectorVest’s shorting strategies saw gains as high as 93% in just 6 months!