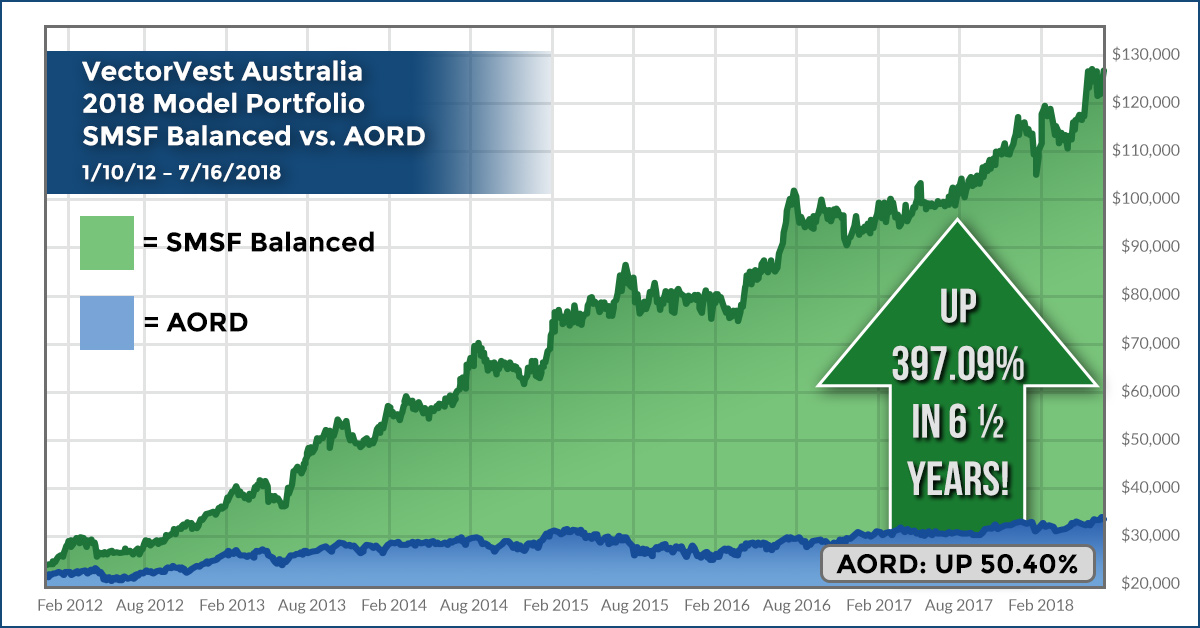

The SMSF Balanced Portfolio finds the balance between growth and income. What if you could find stocks that have capital growth as well as income! At VectorVest, we have seen that stocks in the range between $1 to $5 have had some of the most explosive growth in in recent years as depicted by this portfolio. Below are some of the key mechanics of the SMSF Balanced Portfolio:

- 5 Positions in total at any time

- The stocks being found have a Dividend Yield of at least 2% or higher

- Less than 8 trades a year on average

- Sophisticated Marketing Timing applied to ensure optimum performance

- Only stocks with sufficient liquidity make it into the portfolio

- No penny stocks

- Up over 21% since July ’17 to July ’18 excluding franking credits and dividends

Since the launch of the SMSF Balanced Portfolio in 2012, the portfolio has annualised over 50% per year!

Some of the standout trades in this portfolio over the years:

| Stock Code | Entry Date | Exit Date | Returns |

|---|---|---|---|

| GEM | 24/1/13 | 21/11/2014 | 171.64% |

| GXL | 5/7/2012 | 28/5/2013 | 98.42% |

| CCP | 27/1/2012 | 26/3/2013 | 77.98% |

| VTG | 5/1/2016 | 30/8/2016 | 73.12% |

Take out a trial to find out more about this portfolio and some of the other key portfolios that we track in VectorVest!

CLICK HERE TO GET YOUR 30-DAY TRIAL

Tried to get free report on new and Asl

Did not come through

Hi Jeff. Could I ask that you check your spam filter – it may have ended up in there? If no luck, if I could ask that you give our team a call Australia toll free on 1800303782. The team can assist to ensure you get the report.

Please see the times we are open:

Monday 21:00 – Tuesday 13:00

Tuesday 21:00 – Wednesday 13:00

Wednesday 21:00 – Thursday 13:00

Thursday 21:00 – Friday 13:00

Friday 21:00 – Saturday 13:00

Saturday 23:00 – Sunday 07:00

Sydney time equivalent

Regards,

Russell.

Hi,

I live in Canada and have been with VV for 10 years. Never visited the Australia blog before. I suspect that there are a lot of similarities between the Ausy and Canadian markets. Any chance of getting the actual search and backtest parameters for the model portfolio so I could try it out with VV Canada? Right now I’m taking the Options Paycheck course and I know there are some Ausys also taking it as well

Thanks,

Tom

Hi Tom,

Thanks for checking out the Australia blog. Apologies for the delay, I have been on the road presenting.

I am just about to email you the settings!

Many thanks

Regards,

Russell.