KEEPING AN EYE ON THE MODEL PORTFOLIOS FOR 2021!

Written by: Robert and Russell Markham

As noted last week, for 2020, it was the Income Portfolio that took our top position per the Model Portfolios. The year prior, it was the Growth Portfolio! Who will be the top performer for 2021? At VectorVest, we offer several model portfolios for education purposes. Every position is noted daily with all risk and money management rules noted to you each day. You can stress test, modify accordingly. The power is all yours, we give you the tools so you can perfect your investing!

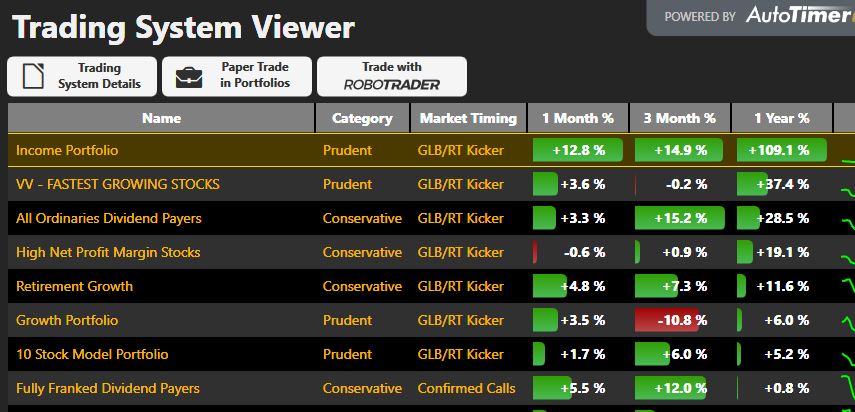

Back to which portfolio will perform best for 2021? I cannot predict which Portfolio will be the standout performer, but I can have a fair idea throughout the year by checking any given Portfolio. Per the Viewers tab, by clicking on Trading System Viewer (on the left of your screen), you can get a snapshot of all the Portfolios we track. The Trading System Viewer gives you a very handy snapshot of what is taking place. As of 12 January, the top performer year-to-date is the Income Portfolio, up 3.2%, followed by The Fully Franked Dividend Payers Portfolio at 2.2% and the Retirement Growth Portfolio at 1.2%.

Let’s now head over to the Portfolios tab as I want to show you how you can keep your eye on the Model Portfolios for 2021. Once you have clicked on the Portfolios tab, click on Go to VectorVest Portfolios. VectorVest Portfolios tracks the 6 Model Portfolios we provide to you each day for Australia. You can see exactly what is taking place and check in on the winning stocks. By simply clicking on each Portfolio, you can see what is currently being held and how the positions are stacking up. Let’s click on the 10 Stock Model Portfolio. If you click on the Purchase Date column heading, such that the dates are sorted in ascending order…you can see the latest positions as they take place. I can see as of 12 January that GSS.AX was added on 11 January and is currently up 1.52%. Ok, no further positions added in 2021 just yet.

Let’s click on the ETFs Portfolio…no positions added for 2021. Based on the performance of the ETFs Portfolio over the years, I would be surprised if there are any trades in the ETFs Portfolio this year. But that is my emotions speaking to me…don’t rely on your emotions…check in on the ETFs Portfolio to get the facts each day. It may very well have a trade or two this year. If you are looking for a Portfolio that rarely does any trades…this may be one you consider for 2021?

Moving on to the next Portfolio, the Growth Portfolio. The top performer for 2019 and held up well in 2020. Will 2021 be the year of the Growth Portfolio? Will the market seek growth stocks like it did in the first half of 2020? Time will tell…looking at the current stocks held, WAF.AX is the only addition for 2021 so far – acquired on 11 January. Keep a lookout for the stocks that the Portfolio rules pickup for 2021 to get some growth stock ideas.

Next up, clicking on the Income Portfolio brings up an impressive equity curve and what a year 2020 was for the Income Portfolio. Looks like the Income Portfolio is in no mood to slow down just yet! The only addition for 2021 is ADH.AX, acquired on 11 January. Keep your eye on ADH.AX in the Income Portfolio along with further additions as the year unfolds.

The next Portfolio to click onto is the Safe and Sure Portfolio. This Portfolio is so safe and sure at present that it is 100% in cash. Don’t let that fool you, the Safe and Sure Portfolio has annualised around 10% returns a year since 2013. It is our lowest volatility Portfolio. It is not our most exciting…but it certainly has proven to be a steady achiever over the years and that is what many subscribers were interested in. Slow, steady with not too much volatility. Let’s see how it goes this year as it re-populates its holdings.

The last Portfolio in the list is the SMSF Balanced Portfolio. Robert Markham designed and perfected this Portfolio. Look at that equity curve since 2012…very smooth over the years. No new stocks for 2021 just yet…keep a lookout for the new holdings as they take place.

I have put together a short video on how I go about looking at all the stocks currently being held across the 6 Model Portfolios and which stocks currently stand out. The analysis is very interesting. I also take a brief look at some of the best Portfolios for the year so far…phenomenal returns and is not even the end of January yet. Make sure you watch the video.

Please CLICK HERE to see the video.

Leave A Comment