How to teach your teenager to take their first trade

Building on the success of one of our most popular episodes ever called “How to talk to your kids about money”, we want to advance the conversation to something that I keep hearing about. Lots of teenagers want to take the plunge into the markets but don’t know where to start. During this episode, we discussed:

– How to set up a trading account

– How to physically buy your first stock

– How parents and can meet teenagers where they’re at

– How to put a simple process in place to make your first decision

– How to avoid the pitfalls of first time investing

View the full episode at https://www.youtube.com/watch?v=8r8kIcNYOEE

1. How to set up a trading account

The first thing that anybody who wants to buy or sell a stock needs is to do is set up an online trading account. There are several brokers out there and in order to make the best decision for you and your teenager, it’s important to ask the following questions:

– What instruments do you need?

(The answer is likely to be equities only)

– What are the costs of each transaction?

(Try to find as low as possible, but watch out for other fees)

– What are the other fees?

(For example, inactivity fees or account management fees)

– What are the costs associated with a foreign exchange if you need to change the currency?

(Will you have to pay extra to move between currencies?)

2. Meeting your teenagers where they’re at.

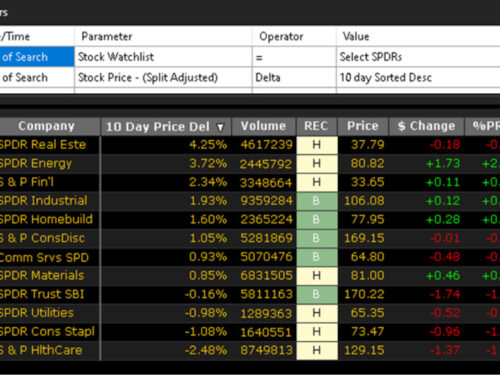

There are three key ways that you can bring the stock market to life with your teenagers. Ask them for the names of companies where they interact already e,g. Netflix, Apple, Microsoft, Sony, Adidas, etc. Show them how to create a Watchlist using VectorVest. If they’re interested in tech, show them the Portfolio functionality and they can dynamically program in alerts, etc. Talk to them about the trends they see around them and how that might impact the stock market in the future. For example, which social media platforms do they think will grow? Which clothing brands are most popular?

3. Walk them through the process of making a trade.

After they’ve set up an account, go through each aspect of what goes into a trade ticket. First and most importantly, they need to determine if they’re buying or selling! After that, they need a ticker code and specifically, the correct one for the exchange and currency of the stock. They will need to type in the amount of money they want to spend (or the number of shares they want to buy, but you’re more likely to be correct with the former). If they want the shares as soon as possible, they would choose a “Market order” and risk that they may have got a better price by waiting a little while. If they want to wait until the price has reached a certain level, they can choose “Limit order” but risk that it doesn’t reach that price. A full demonstration of this is in the video.

4. Decide the premise of their investment

While we could talk for hours and hours about what to buy, there is one underpinning decision that they need to take. Is this a lump sum that isn’t to be followed up any time soon or is this the start of regular investing?

If your teenager is planning to invest a lump sum, it’s important that they look at some Market Timing indicators. If they’re going to buy some shares regularly over time, then they may buy at higher levels and then lower levels and then higher levels again, but their exposure will average out over time.

5. A couple of final points!

Remember that the market is future-focused. If a stock had a superb performance in the past two months or even two weeks, that doesn’t predict anything about the future. You need to think about future earnings, dividends, and prospects in order to make money in the stock market from when you buy and not look in the rearview mirror.

The market is a moving and changing place. Prepare them for volatility. It happens, but you feel it SO much more when you have some stocks rather than a paper portfolio. Discuss how they feel when their stock goes up and down to get an insight into their risk profile and help them become more aware of their investing personality.

Let them feel the consequences. If they pick a stock that tanks, let them build up their savings to buy something that has better prospects. I suggest avoiding the temptation to bail them out. That’s the reality of investing and there may be times when they pick stocks with amazing performances (and then you will need to deal with they may take a disproportionate amount of credit!)

Point out that things change over time and not overnight. If a company was to grow at 10% per week in the real world, it’s unlikely to be able to sustain that pace for long. Businesses seek to sell goods and services at a profit. Some give a piece of that profit out in dividends. The rest is reinvested into the company to have a greater impact in the next financial period. This is a process that happens over time. Share prices can fluctuate wildly, but if you look at a ten-year graph and understand that behind every ticker code is a company and behind every company is a group of people with a business model relating to customers, then they have a better chance of making a success of their investment journey.

Leave A Comment