AU BLUECHIP STOCKS IN A CONFIRMED UP.

Written by: Robert and Russell Markham

We travel a lot around Australia and spread the word on the power of VectorVest! As we note, why do all the work when VectorVest does it for you? You don’t have to do it on your own. A huge time saver and a comfort factor knowing we are here to help, giving you the edge, the tools and the confidence to do it yourself. Let me demonstrate this week:

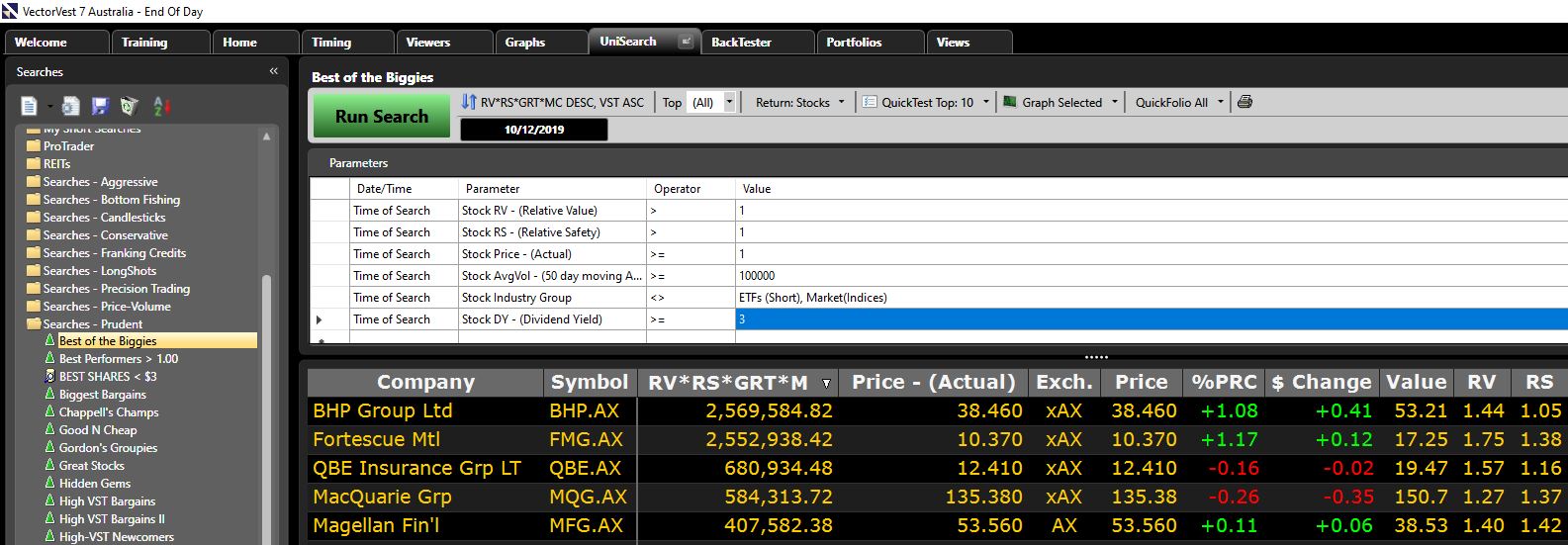

I went back to the last Confirmed Up (C/Up) on the 25th of October. I was simply looking for big household names with a long track record in the market that could offer me some good upside potential. One of my favourite blue-chip searches is housed in UniSearch Group Searches -Prudent. Within Searches – Prudent, there is a search called Best of the Biggies. This search finds the biggest listed companies on the ASX with the best combination of fundamentals and technicals and you can run this search each day. Click on the Best of the Biggies Search (click on UniSearch, then Searches – Prudent) such that you can see all the parameters that the search uses.

Best of the Biggies ensures Relative Value (RV) and Relative Safety (RS) are both above 1.00 (as ranked on a scale of 0.00 – 2.00). RV and RS are our key fundamental indicators and we are ensuring the fundamentals stack up. The search ensures no penny stocks are returned (where price must be greater than or equal to a dollar). In addition, there is plenty of liquidity with the 50-day Moving Average of Volume requiring at least 100,000 trades a day. The search excludes any Contra ETFs (currently BBOZ.AX and BEAR.AX for Australia). Once all the parameters are met, the stocks are then sorted by RV * RS * GRT * MC Desc. Where GRT is the one to three year forecasted earnings growth rate in percent per year and MC is Market Capitalisation which is the current share price times the number of shares outstanding (per the “Shares (M)” column in Stock Viewer).

If I go back a few weeks ago to the last C/Up on 25 October and run: Best of the Biggies the top 5 stocks back on the 25th of October are as follows: BHP.AX, FMG.AX, CSL.AX, MQG.AX and STO.AX. If I QuickTest the top 5 from 25 October through to 10 December, I get 6.61% returns for the last 6 weeks (outperforming the market more than 4-fold for that period). Very healthy returns for 6 weeks compared to a term deposit or a bond rate! Since the 25th of October, the 5 noted stocks above have not had their VST scores fall below 1.00 and the Earnings Per Share (EPS) graphs have held up very well. CSL’s earnings have powered on significantly in recent months!

And if I wanted to ensure great dividends on offer, I can just simply add in an additional parameter into Best of the Biggies. If you click on the next blank Parameter box and then hover my mouse over Stocks, then Divided Analysis, then select DY – (Dividend Yield). Set the Operator to read >= and then in the corresponding Value box, select and enter 3. This will ensure only stocks with a 3% DY that meet the Best of the Biggies search are returned.

(Click on the image to enlarge)

(Click on the image to enlarge)

If I run the modified Best of the Biggies UniSearch as of 10 December, the top 5 I get are as follows: BHP.AX, FMG.AX, QBE.AX, MQG.AX and MFG.AX. All these companies are paying at least a 3% dividend yield and meet the Best of the Biggies criteria! Out of interest, BHP.AX, FMG.AX, QBE.AX, MQG.AX and MFG.AX since the start of 2019 (2nd January), these stocks have returned just over 70% year-to-date with FMG.AX leading the pack returning over 150% followed by MFG.AX up over 130%.

Next time you are considering some BlueChip stocks when we are in a Confirmed Up Call, have a look Best of the Biggies!

DISCLAIMER: THE ABOVE ARTICLE DOES NOT CONSTITUTE FINANCIAL ADVICE. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU SHOULD CONSULT WITH YOUR LEGAL, TAX, FINANCIAL, AND OTHER ADVISERS PRIOR TO MAKING ANY INVESTMENT

Leave A Comment