Warnings Signs to protect your portfolio

Could you have foreseen Covid 19 back in January this year and what impact it was to have had on the market? I for one could not have foreseen it. In fact, I have not run into anyone that clearly saw the disaster coming. It was a totally unpredictable event… who could have foreseen 2020 as the year a pandemic was to take place?

There have been warnings out there in the past that a pandemic would take place at some point. Bill Gates briefed Trump back in 2016 of the likelihood of a pandemic. But did anyone really pay any notice? Were you aware of this? I was not until after the fact. Is it not fair to say that a pandemic is always a threat and the possibility is out there, along with fires, floods, earthquakes, and the likes? The key is to know when such an event is likely to take place and prepare accordingly.

Unless you are watching every news item closely and constantly living your life in anticipation of the next market disruption … how do you protect our portfolios for an unforeseen market disruption? One way I like to keep my portfolio safe is to have a look at what my stocks’ earnings are doing. Companies that are growing their earnings, year in and year out are companies that are more likely to weather storms and give me more time to move to the sidelines if required. Take for example Northern Star Resources:

Click on image to enlarge

The blue area line represents the earnings for Northern Star Resources. Rising earnings… rising share price. Now if an unforeseen event takes place… would you rather have a set of shares in your portfolio with rising earnings as opposed to a set of stocks with falling earnings?

Case in point, look at the earnings profile for Reece Ltd

Click on image to enlarge

Over the years at VectorVest, we have seen time and time again, companies with falling earnings are result in falling share prices.

A lot of share investors note “I do not want to sell my stocks as I need the dividends and franking credits.” At VectorVest we never advocate a buy, hold and hope type strategy. This sort of strategy can result in significant losses. However, I do appreciate the need for retirees to earn dividends and franking credits.

As such, what types of companies will typically pay consistent dividends… are these companies earning more and more money each year, or are these companies losing more and more money each year? A rhetorical question… right? We want to back companies that have a track record of making more money each year. In addition, we would no doubt like companies that are paying more and more dividends each year. Finally, our last key requirement is to find companies that are growing their earnings year because companies that are growing their earnings are likely to be companies growing their dividends and share prices.

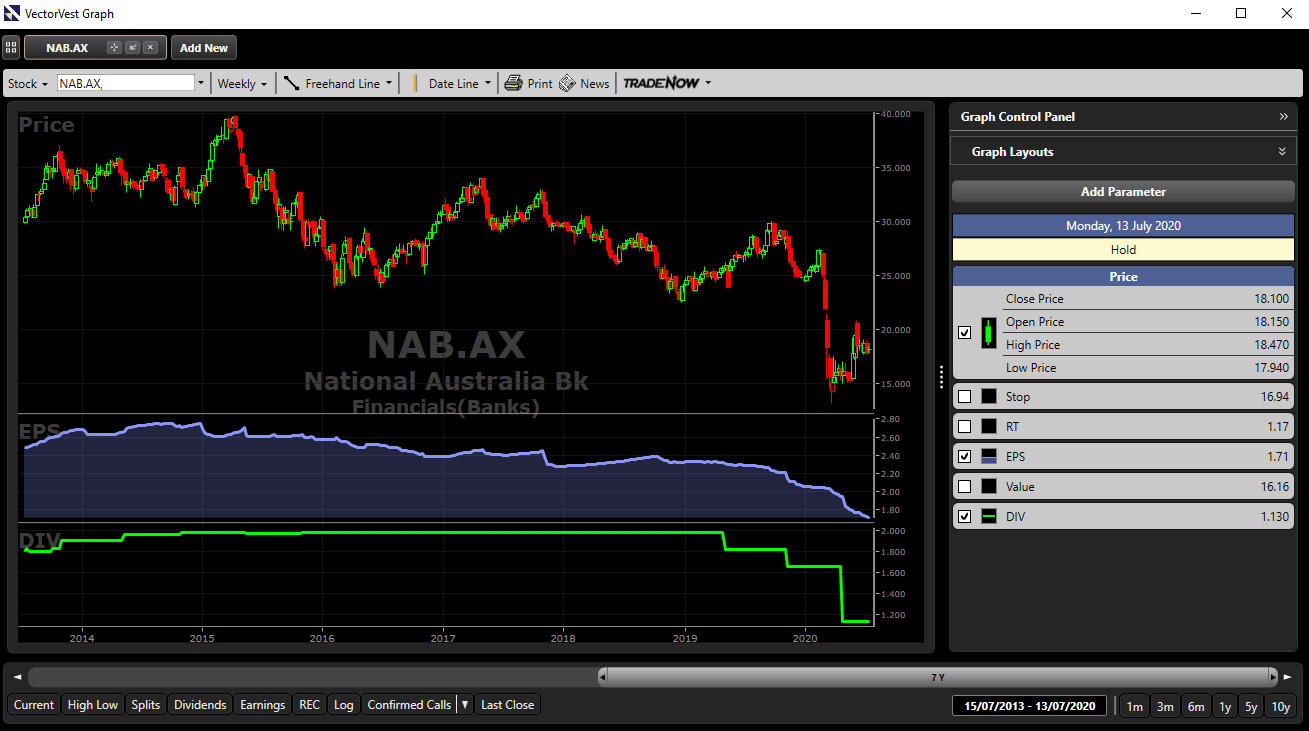

Take the example of National Australia Bank. For many months now, we have been watching the earnings profile deteriorate. As a result, the dividends were cut in recent months. This is not something new at VectorVest… we have been seeing this pattern play out time and time again

Click on image to enlarge

What other proactive measures could you have taken to protect yourself in an uncertain market? I am going to detail 3 additional measures:

Apply Stop Losses

But stop losses will potentially sell my shares and I will not get my dividends! Yes, that could happen… but what if your stock drops by more than your dividends? Then you will have lost more than you made. Chances are, without stop losses, you will lose significantly more than you will make from dividend and franking credits. Once your stop loss is triggered, and you sell out, you can always buy back in! Think of this as having the option to buy in more at a lower price to be in the running for those great dividends you are after.

Buy Puts

Buying a put entails buying an option, that being a put option. At this point, most people look uncomfortable. “Options are super risky, and I am not interested in options” will most likely be what you are thinking. Do not let the negative media articles on options distract you. Yes, plenty of options trades can be highly risky. Too many investors out there take the get rich quick type options trades that invariably ends badly… and these stories are the ones you typically read about. However, if used correctly, options can protect your portfolio. A put option can be compared to buying insurance. Nobody likes to pay their insurance premiums, but when something happens that we are insured against, we are pleased to have paid our insurance.

A put contract gives you the right, not obligation, to be able to sell your given shares at a certain price at a certain time. One contract controls 100 shares. If you own 100 BHP shares for example and you were concerned the price could fall in the near future but you wanted to hold onto BHP to receive your dividends, you could consider buying one put contract on BHP. Put contracts go up in price as the price of given stock (BHP) goes down in value. The contract becomes more valuable the lower the price falls on BHP. You can of course buy more than 1 contract. And no, buying a put contract does not mean you have to sell your shares… you simply sell your put contracts to another buyer.

Buy Inverse or Contra-ETFs

Contra ETFs are ETFs which are designed to perform the inverse to what the market is doing. For example, BEAR is a listed ETF on the Australian market. It is designed to seek returns that are negatively correlated to the ASX 200 index. As the ASX 200 index falls, BEAR is setup to benefit from this and rise in price. Investors can consider Inverse ETFs in in their portfolios to soften the impact of falling markets. As the market rallies, the inverse ETFs by nature typically do not perform well. So this may be a strategy you only consider in a bear market. Two other inverse ETFs you may consider for the Australian market are BBUS and BBOZ.

Go To Cash

Cash is a position. It is not ideal if you are after dividends and franking credits. But again, one must weigh up the possibility of losses exceeding dividend yields.

Although I was not able to give you insight on how to look for the next unforeseen market disruption, I was able to show you what to look for in your portfolio. Are your shares earnings rising? Do you have stop losses in place? Have you considered inverse ETFs or cash as a position in the next downturn?

Want to find out how easily you can implement the above? Take out a 30 Day Trial to VectorVest today!

CLICK HERE to take out a 30 day trial to VectorVest.

Leave A Comment