Hello everyone,

Lithium stocks have been on the radar in recent month – and for good reason. Some of the returns have been nothing short of spectacular. However, a closer inspection of these stocks revealed that all but one as of today’s date are penny stocks. However, there is money to be made for the more aggressive investor willing to look more closely at penny stocks! One of the key challenges I was going to have was to try mitigate volatility often associated with penny stocks.

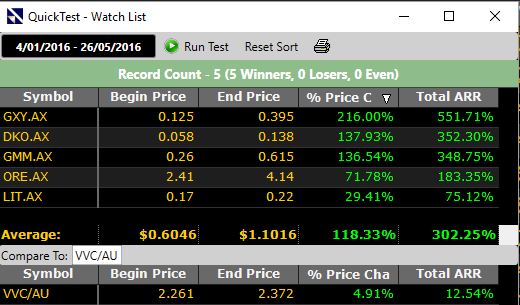

I got to work and decided to research some of the key lithium stocks in Australia. Once I had compiled a list together I put the list into a watchlist. From there I was readily able to rank, sort and edit my watchlist at a few clicks of the mouse.

I decided to sort the lithium stocks by VST – our master indicator – so as to screen the stocks for Value, Safety and Timing (hence VST) – and I set the date back to 4 January 2016 (the first trading day of the year) and ran the test to 26 May. Not bad going! However, there was significant volatility along the way.

Take a look at the video below to see how I went about analyzing the stocks further using VectorVest – and how I applied a very specific sort to the portfolio to smooth things out. There are some very interesting results!

Please note – the watchlist that I used in the video comprised of:

AJM.AX, BGS.AX, CMY.AX, DKO.AX, EMH.AX, GMM.AX, GXY.AX, KAI.AX, LIT.AX, LRS.AX, LTX.AX, NMT.AX, ORE.AX, PLS.AX, PSM.AX, RNU.AX, RVR.AX

This list certainly is not definitive or all inclusive – but a fairly accurate representation of the lithium industry at present.

DISCLAIMER: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU SHOULD CONSULT WITH YOUR LEGAL, TAX, FINANCIAL, AND OTHER ADVISERS PRIOR TO MAKING AN INVESTMENT WITH VECTORVEST

Russell, many thanks for the blog. Your comments lead me to the more obscure sections that I would not find in my normal searching.

Thanks David. Yes, it certainly was interesting to look at the lithium stocks – we can keep tracking the portfolio to see how it progresses. Regards, Russell.