Lowes (LOW) reported second-quarter earnings in Tuesday morning’s trading session. So far, the news has sent shares more than 4% higher as the company may be suffering from a setback in sales but remains optimistic and upheld its full-year outlook.

Revenue for the fiscal second quarter came in at $24.96 billion, which was just shy of the $24.99 billion expected by analysts. However, earnings per share of $4.56 came out on top of the $4.49 consensus estimate. This was a slight step back from this time last year when the company reported an EPS of $4.68/share.

While the company flourished in the springtime as consumers made way through home improvement projects, Lowes is expecting DIY discretionary spending to slow down for the second half of the year. This is the result of people enjoying their summer and fall/winter weather getting in the way of new projects.

All that being said, the home improvement retailer isn’t worried about dwindling sales. In fact, CEO Marvin Ellison said on his call with investors and analysts that the low housing availability and older age in the US is reason to be optimistic for the long term.

The company took the time to point out that they are performing as expected – and that the high demand fueled by COVID-19 shouldn’t be used as a benchmark for results. Sales surged during and just after the pandemic, but as the world returns to a sense of normalcy, businesses are as well.

In saying all this, the company stuck by its previous full-year guidance of total sales between $87 billion and $89 billion. Meanwhile, EPS will range between $13.20 and $13.60.

So far this year, LOW is up nearly 10%. But, is this earnings report enough to justify buying this stock? It was a bit of a mixed bag, which may leave investors wondering where it leaves them.

The good news is you won’t have to play the guessing game or make any decisions based on emotion. We’ve taken a look at LOW through the VectorVest stock analyzing software and have 3 things you need to see that will help you make your next move with confidence.

LOW Has Good Upside Potential and Timing With Excellent Safety

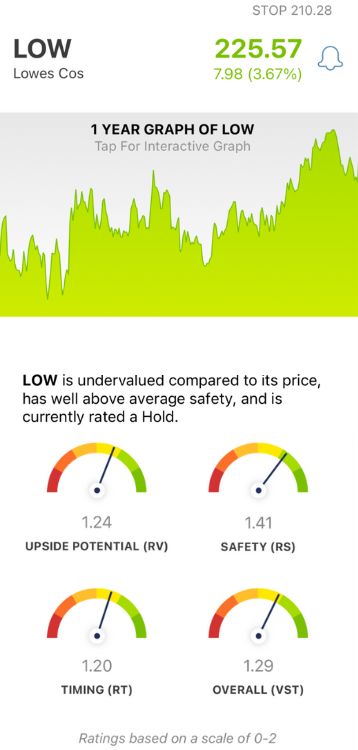

The VectorVest system issues a clear buy, sell, or hold recommendation for any given stock, at any given time based on a simple proprietary stock rating system. It’s made up of 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings is easy to interpret as they sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings above the average indicate better performance and vice versa. As for LOW, here’s what investors or prospective traders need to be aware of:

- Good Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years ahead) to AAA corporate bond rates and risk. LOW has a good RV rating of 1.24, and is also considered undervalued in the VectorVest system. The stock’s current value is $267/share.

- Excellent Safety: The RS rating is an indicator of risk and comes from a deep analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for LOW, the RS rating of 1.41 is excellent right now.

- Good Timing: The RT rating speaks to a stock’s price trend. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. And right now, LOW has a good RT rating of 1.20!

The overall VST rating of 1.29 is considered very good for LOW. does it earn the stock a “buy” recommendation, though? Or is there any reason to hold off or consider selling?

Make your next move with complete confidence. Get a free stock analysis at VectorVest today and get a buy, sell, or hold recommendation for LOW based on a tried-and-true system that has outperformed the S&P 500 by 10x over the last two decades and counting!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After a mixed bag of results in the company’s earnings report, shares of LOW climbed more than 4%. The stock has good upside potential and timing with excellent safety to back it up.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment