Delta Air Lines (DAL) delivered first-quarter earnings that came in above what analysts were expecting thanks to strong travel demand for the quarter. Better yet for shareholders, the airliner expects this trend to continue into the quarters ahead.

The company brought in revenue of $12.6 billion, a record for the first quarter, compared to the $12.5 billion analysts expected. While this was a narrow overperformance, earnings itself was more decisive at 45 cents per share on an adjusted basis compared to the 36 cents Wall Street was anticipating.

This lift was provided in part by a 14% uptick in corporate sales for the quarter, as business travel burgeoned – and will continue to do so going forward. Delta says that 90% of companies polled will increase or maintain their travel volume through the summer and the remainder of the year.

As a result, the second-quarter EPS outlook for Delta is optimistic at $2.20-$2.50 per share. This is setting up nicely for another beat on the bottom line with analysts expecting just $2.22 per share. This will be a slight step backward from the same quarter last year in which Delta reported $2.68.

The company did stand by its original full-year guidance of $6-$7 per share. Because despite the solid first quarter and upbeat guidance for the road ahead, the airliner does have a few challenges to face. For example, average jet fuel prices are up 4.3% globally amidst tensions in the Middle East.

DAL didn’t move much in Wednesday’s trading session on this news. The stock gained around 4% before the market opening but has since settled at around even on the day. That being said, it has been making moves leading into this news – up more than 11% in the past month and 18% through 2024 thus far.

So, is now a good time to buy DAL? We’ve found 3 things you need to see in the VectorVest stock software that will help you make your next move one way or the other.

DAL Has Fair Safety With Very Good Upside Potential and Timing

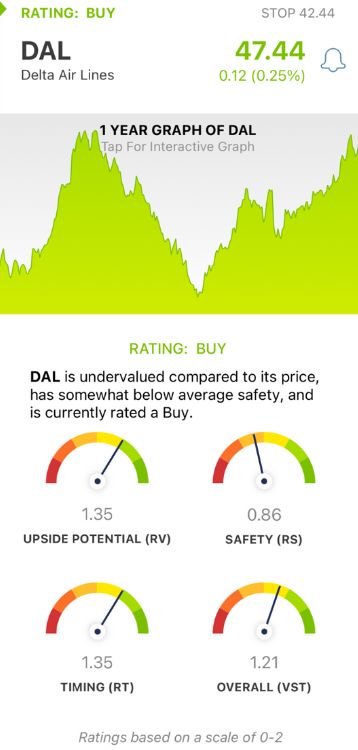

VectorVest empowers you to save time and stress while winning more trades through a proprietary stock-rating system. It tells you what to buy, when to buy it, and when to sell it all in just 3 intuitive ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. You’re even offered a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for DAL, here’s what we uncovered:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This is a far better indicator than the typical comparison of price to value alone. DAL has a very good RV rating of 1.35. Furthermore, the stock is undervalued with a current value of $62/share.

- Fair Safety: The RS rating is a risk indicator. It’s computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.86 is a ways below the average for DAL, but still deemed fair nonetheless.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. As you can see from the stock’s performance, DAL has a very good RT rating of 1.35.

The overall VST rating of 1.21 is good for DAL and enough to earn the stock a BUY recommendation in the VectorVest system.

But before you make your next move one way or the other, take a closer look through a free stock analysis at VectorVest today - don’t let this opportunity pass you by!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DAL delivered on both the top and bottom line in Q1, and expects to ride the strong travel demand trend through the next quarter and beyond. The stock itself has fair safety coupled with very good upside potential and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment