Blockchain Stocks Australia

Have you been following the Bitcoin price in recent days? I have watched with interest as the price of Bitcoin surged. I recall looking at Bitcoin back in 2015 when it was nothing more than a speculative type of gamble. I could not help being fascinated by the blockchain technology and its future use applications. Things changed a lot from 2015 and by 2017 there was a frenzy of retail investors into Bitcoin. Investors had started to see the possibilities of blockchain technology. However, many investors were jumping in on the hope of making quick, easy money.

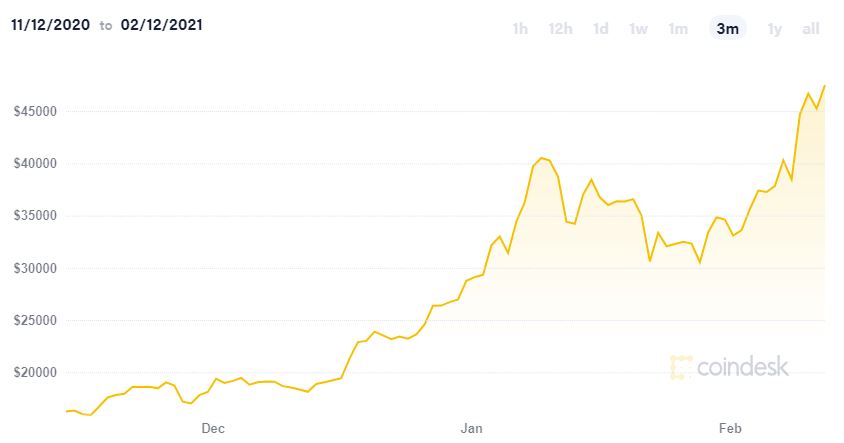

I sat back and watched Bitcoin hit the dizzying heights of nearly $20,000 USD per coin in 2017, only then to spectacularly pop and drop in price all the way down to 3,000 USD by the following year. Many market analysts and commentators were calling the end to Bitcoin. Roll this narrative forward to the 9th of February 2021 and Bitcoin breaking through $47,000 USD per coin. This time round, it appears that institutional investors are driving the price rather than retail investors. Numerous institutions have come out and disclosed their bitcoin holdings in recent months.

Bitcoin appears to have transformed from a speculative asset to an asset that currently has a market capitalisation larger than Berkshire Hathaway, larger than Visa, Johnson and Johnson and JP Morgan to name a few. But be warned, Bitcoin has been a volatile investment! Not for those who do not like significant and often violent price movement. Having said that, you may have seen in the news this week noting that Tesla (TSLA ticker code in the US) converted $1.5 billion USD of its treasury reserves to Bitcoin. In addition, TSLA noted that it would look to accept Bitcoin as payment for its electric vehicles. A couple of weeks prior, MicroStrategy (MSTR ticker code in the US) also invested over $1 billion USD into bitcoin. There have been several other corporate investments into Bitcoin too… and it appears that bitcoin may very well be adopted by more institutions in the months and years ahead. Time will tell.

Bitcoin operates on the blockchain and is the biggest and most trusted coin operating on the blockchain. The blockchain provides the ability to record transaction on an open book ledger where the system cannot be cheated, manipulated, or changed. Real world applications for this new technology are well advanced. But with all new technology, it can be volatile! Look at Amazon, Tesla and the likes over the years. However, the driving technology behind these stocks is what gives them the edge. Is bitcoin a great technology? I found an interesting read in the Sydney Morning Herald on Bitcoin for those of you interested – click here to read.

The issue for many investors is that you cannot call-up Bitcoin and ask to speak to the owner or managers. There are no financials filed each year. As such, most investors are never going to look at Bitcoin. Fair enough. But there is another way to invest…and you guessed it, via listed stocks on the share market that have exposure to blockchain and bitcoin. You can get the best of both worlds… get exposure to blockchain/bitcoin along further diversification per the company you invest in. For example, TSLA has a fair bit of exposure to Bitcoin but its key revenue source is electric cars. I personally prefer to invest via a company that has exposure to bitcoin than directly into bitcoin itself. If bitcoin fails, the other prevailing revenues in the given company will shield me. If bitcoin continues its growth trajectory, I benefit via the shares that have exposure to bitcoin.

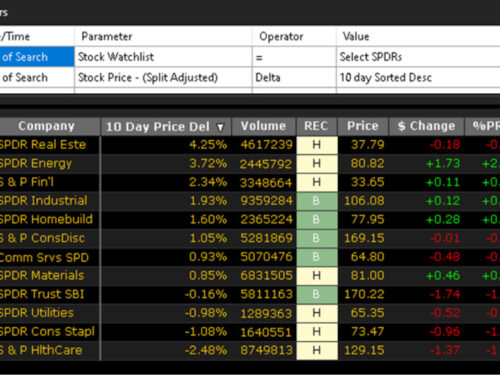

Let’s take a closer look at the blockchain/bitcoin companies that operate in Australia. Does Australia currently have any standout performers? The team have put together a WatchList on the blockchain stocks in Australia. Per the video link, I will show you exactly how to locate this WatchList for Australia. The list entails 22 stocks. All the stocks are penny stocks! One needs to be very careful. Some of these stocks may very well benefit from the blockchain narrative over the next few years. However, for now, these stocks are still in the early stages. Most of these stocks were not listed 7 years ago.

In the video, I go over blockchain stocks for Australia and take a closer look. I then move over to the US market and take a closer look at 2 key blockchain stocks in that market and note a blockchain stock that has grown at a faster rate than bitcoin!

CLICK HERE to see the video.

Leave A Comment