IS NICKEL THE NEW GOLD?

Written by: Robert and Russell Markham

Are electric cars becoming more prevalent? Have you noticed? I was heading out the other day and I saw 5 Tesla vehicles in the 10-minute trip. The reason I noticed them is that I did a double take at a car I had not seen on the road before. I was fortunate enough to stop at the traffic lights right behind this very vehicle – a rather impressive looking car. I squinted away out of curiosity as to who manufactured the car. And there it was: Tesla! Maybe I have seen that model of Tesla before and did not notice…but last week I certainly became aware and then noticed several Tesla vehicles.

What am I getting at with all this discussion on Tesla? Batteries! That is the key word here. Tesla uses batteries…and as more Teslas are sold, more batteries required! So? Well, batteries need Nickel. Is Nickel the new gold? Well, maybe not so fast…but certainly Nickel is in demand as we move toward more electric vehicles. But it is not just the battery makers that need Nickel, the steel producers need Nickel too. Nickel is used to make stainless steel production, and to plate metals to ensure they do not corrode (for those who are not into metallurgy).

Has the demand for Nickel increased as a result? If I refer you to Kitcometals.com: http://www.kitcometals.com/charts/nickel_historical_large.html. There are some interesting charts noting the Nickel warehouse stock levels as tracked by the London Metal Exchange (LME) along with the price charts. I can see that 5 years ago, the stockpiles on the LME were around 450,000 pounds and now around 250,000 pounds. I can see that Nickel stocks levels were nearly at 50,000 tonnes by November 2019. The stockpiles have built up since and, as such, you would think that the rising supply would dampen price. However, the 5-year view puts the stockpiles into perspective. Also, have a look at the 5-year price chart for Nickel. Back on October 2015, Nickel was trading at $4.50 USD per pound. Today, the price is over $7 USD per pound.

I researched a little bit more and came across some interesting graphs on the outlook of Nickel per this link: https://seekingalpha.com/article/4377121-nickel-monthly-news-for-month-of-september-2020. If you get the chance, read up on some very interesting analysis on Nickel. The graph on the forecasted battery demand for electric cars (forecasted to 2030) makes a strong case for Nickel! Time will tell, but electric cars appear to be well and truly here to stay.

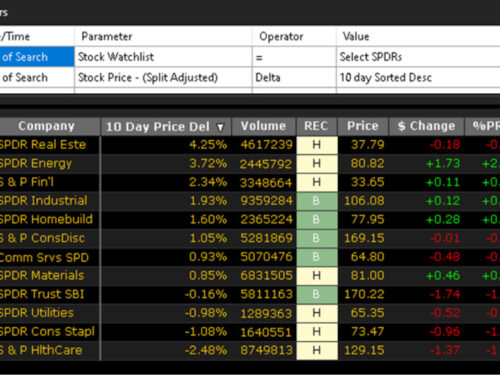

Let’s get to work identifying some key Nickel players to see which Nickel stocks for Australia stack up. To get started, click on the Viewers tab and then Click on WatchList Viewer. The group I want you to click on is entitled: Commodities. Per the second WatchList down, click on Nickel. This will list all the stocks we have complied that are involved in Nickel. Many of these stocks are not pure Nickel plays. Many mining companies out there mine several metals or are yet to start mining anything! As such, this list breaks out companies that we have identified as having some exposure to Nickel whether it be production of Nickel, exploration of Nickel or in joint ventures with other Nickel miners etc. Hover your mouse at the very bottom of the Nickel WatchList, per the WatchList Average line, right click and then select View WatchList Average Graph. Set the graph to be five years back. You can see the average price of these Nickel related companies have been very volatile over the last five years, but the overall trend has been up.

In the video that follows, I am going to show you how we are going to take the Nickel WatchList and how we will refine it further. By the end of the video, I will narrow this down to 4 stocks that you may wish to take a closer look at! I want to show you the methodology of how we do this. So please do take the time to watch the video and have a closer look at Nickel next time you are in the WatchList Viewer!

CLICK HERE to see the video.

If you are not a susbriber, trial is out for 30 days! Here is the link to trial us out: www.vectorvest.com.au/trial

Leave A Comment