REAL ESTATE INVESTMENT TRUSTS.

Written by: Robert and Russell Markham

Have you been watching the performance of REITs recently? Have you heard of the term REITs? A REIT stands for a Real Estate Investment Trust. You can buy and sell REITs on the ASX, just like you would a stock. VectorVest currently tracks 39 REITs. To locate the REITs WatchList, click on the Viewers tab and then click on the Special WatchLists Group (under the WatchLists heading on the left-hand side).

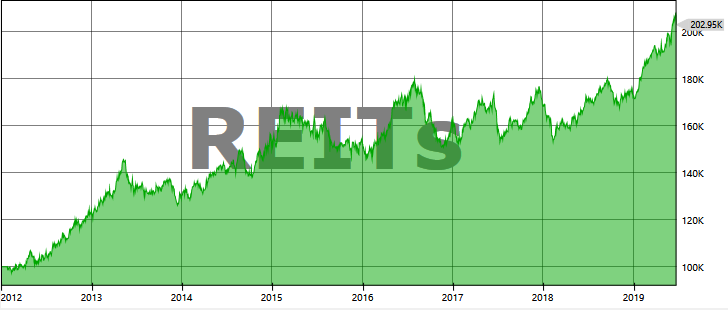

Let’s test all the REITs in the WatchList since the start of the year. Click on the dropdown arrow just to the right of the QuickTest button and then select: QuickTest All. The QuickTest box will pop up. Change the date to be 2 January 2019 and run this through to 18 June 2019. We want to look at the performance for 2019 so far. As of 18 June, I get 29 Winners, 10 Losers and a total average return on 9.21% for the year-to-date, with that equating to an annualised rate of return of over 20%. A good snapshot to begin with, but this does not tell us the journey that took place to get to 9.21% and we would certainly not have bought all 39 REITs, but a good indication to begin with. The REITs have, on average, had some good returns this year so far. But property prices are falling so how can the REITs be doing well?

When I was researching up on REITs, like many others no doubt, I thought that falling property prices would be a big driver in pulling down the performance of REITs listed on the stock exchange. As I researched further I discovered that one of the key drivers for REITs is the performance of the developers that the REITs invest into, as the developers drive a lot of the margin. Not a lot of exposure is at the retail level for many of the REITs. Furthermore, REITs are much more exposed to industrial and commercial real estate with residential real estate only making up a smaller exposure on average. While the developers continue to construct commercial and industrial projects and the likes, REITs are likely to continue benefiting. However, it is fair to say some REITs have had a fair bit of volatility over the years. Despite some of the volatility, there are some great dividends on offer. What if we could weed out some of the volatility to be in the running to pick up some of the dividends while growing the investment?

That got me thinking, how would a BackTest stack up in trying to get the most out of REITs? Let’s set-up a BackTest where we apply the Confirmed Signals to enter the market and exit the market. For the stop-loss, I am going to apply a specifically tested ProfitLocker Stop-loss. ProfitLocker is a default Stop-loss in the VectorVest system and it allows for me to perfect my stop-loss for this exercise. If you have a chance, how do your REITs stack up in the BackTester?

The power of BackTester is that it allows for you to perfect your testing before you commit any hard-earned money. You can be informed and prepared. Think about the person who is considering some REITs in their portfolio who has never heard of BackTester or even contemplated testing their investment strategy.

CLICK HERE TO SEE THE REITS BACKTESTING VIDEO

And there you have it, a BackTested REITs portfolio that you can work upon further to see what you think. I don’t know about you, but I can’t invest without BackTester! I would be lost without it.

Special Note: At the time of recording the REITS BackTest, there were 40 REITS listed. However, one has been removed due to removal from the ASX Exchange, so you will now only see 39. It does not affect the result of this BackTest.

DISCLAIMER: THE ABOVE ARTICLE DOES NOT CONSTITUTE FINANCIAL ADVICE. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU SHOULD CONSULT WITH YOUR LEGAL, TAX, FINANCIAL, AND OTHER ADVISERS PRIOR TO MAKING ANY INVESTMENT

Leave A Comment