Hi everyone,

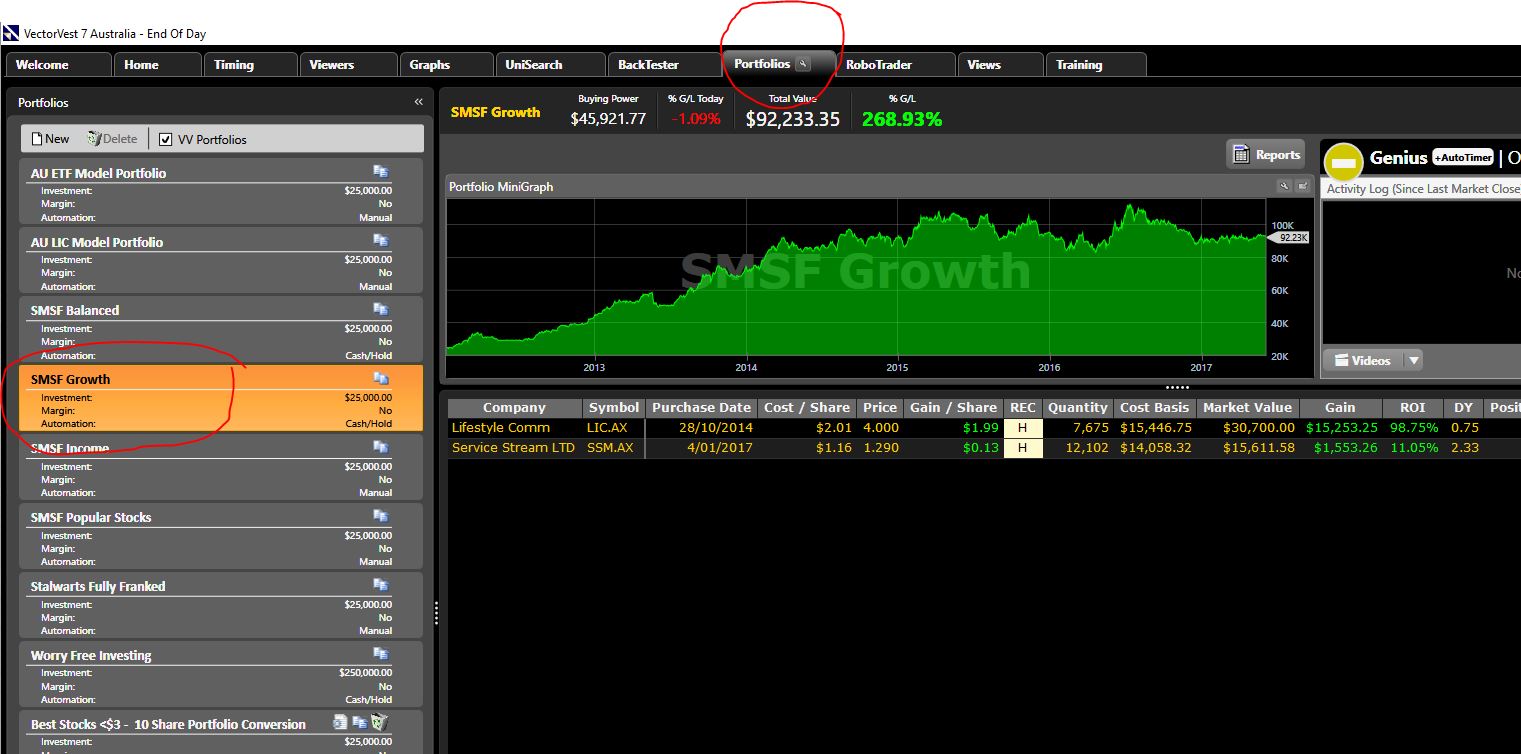

I got thinking about a revised growth portfolio for consideration. We have an excellent growth portfolio under the Portfolios tab – called SMSF Growth

(click on image to enlarge)

This portfolio applies 5 stocks – as we have found over the years in Australia – a 5 share portfolio typically outperforms a 10 share portfolio.

For a growth portfolio – I believe it would be beneficial to also have the option to consider a 10 share portfolio – whereby one can diversify across further industries and sectors due to more shares in the portfolio and therefore have more opportunity to spread their capital. The downside to such a strategy is that it could entail a lot more trades and in turn more work.

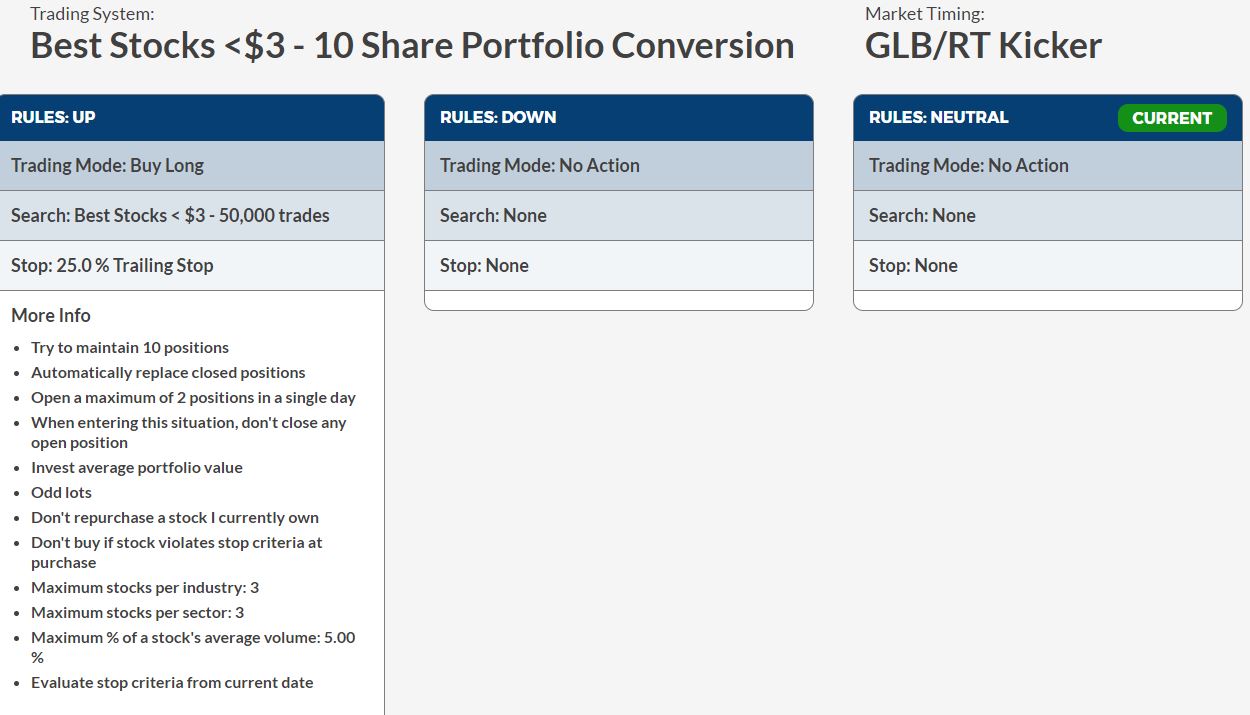

I set out to overcome the amount of trades while increasing the diversification. The end result is stacking up so far:

(click on image to enlarge)

In the video that I provide below, I have set out the exact settings to build this portfolio:

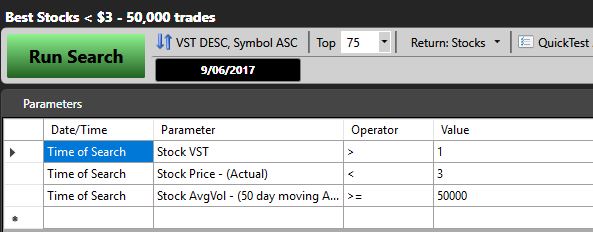

(click on image to enlarge)

Per the above settings – I custom built a new search – “Best Stocks <$3 – 50,000 trades” – I took the search “Best Stocks <$3” housed in the Precision Trading Folder in UniSearch and modified it to reflect a minimum average volume being traded each day on average. The UniSearch I created to complete this Back Test is as follows:

(click on image to enlarge)

Some of the key considerations in the portfolio:

- No more than 5% of a stocks volume on average purchased in any given day – to avoid moving a stock

- No more than 3 stocks in any given sector or industry – to ensure we are diversified

- Limiting the number of trades to 12 trades a year on average

- Has to be realistic

To see how to put this portfolio together, please check out the video: CLICK HERE TO SEE THE VIDEO

Let me know in the chat box below – any other considerations. Is this realistic – is this something that makes sense? Can we improve this further?

Regards,

Russell.

Russel, I have been doing a significant amount of back testing and my results show that a better result is achieved if I do not use the Market timing feature. My best performing back test i converted to an automatic portfolio and it has achieved a 19% gain since 1/3/2017. The portfolio is based on a maximum holding of six stocks which are selected from a Watch list. I know that Market timing is a significant pillar of the vector vest system but could it be different in the Australian market?

Hi Paul. Thanks for your comment. Market timing is a critical component – we never know when another market shock could take place – and as such need to have our plan in place to cater for this. Market timing also helps us with drawdown as well. If we are buying stocks into a falling market – this will increase volatility.

The reason I have gone for 10 stocks – it give one more opportunity to spread capital. It can get difficult to spread say $200,000 across 5 stocks. One of the best techniques for perfecting backtests – run your preferred backtest – then change one parameter at a time and compare to see what the outcome is. If I remove market timing from many of my backtests – the results show much more drawdown and in many cases worse annualised returns.

Regards, Russell

Hi Russell,

Great results over the period tested post the GFC however I’ve run the backtested from the earliest possible date for GLB/Kicker (20/2/2007 – 31/3/2017) and the results are a lot worse with CROR of 6.88% and Max DD 57%. This period obviously picks the year leading into the start of the GFC and hence why the impact on performance, but this is perhaps more realistic of the performance considering these market shocks do occur reasonably regularly. It would be good to be able to do our backtesting further back to see how it performs starting say in 2003 but I assume if VV had that data it would be there.

Any comments on this result as a 57% DD would be hard to stomach.

By the way I think the VV tools are brilliant and it shows how strategies work in some market conditions and not in others so getting this longer term perspective is useful to maintain confidence when the strategy being used is working through a tough patch (eg: sideways markets).

Cheers

Jeff

Hi Jeff,

Thanks for your post. Yes, if I run this back starting in 2007 – the results are not as strong. The key aim here is to find out what is working right now – going back 5 years is far enough to get a good idea. I would note that going back 3 years is sufficient to work out what is suitable right now.

You raise a good point in terms of a portfolio able to withstand events like the GFC. The Worry Free Portfolio – this has been tested back since 2007 and stacks up very well – it has annualised 13.68% (as of writing this blog today) with a maximum draw down of 12.20% since 2007! Not bad going. If you want the peace of mind on a portfolio that has weathered the GFC -the Worry Free Investing portfolio is the one to look at. The growth portfolio that I have put forward – I believe this will work very well in current market conditions – but would need to be revised if the market conditions became adverse.

However, 6.88% ARR since 2007 does not take into account any dividend and franking credits along that journey – so this would be well over 7% annualised since 2007. However, the draw down would be too significant for many during the GFC in this portfolio.

This is a starting point – so I can certainly look to test further back. This portfolio provides a very strong performing portfolio from 2012 for consideration.

Regards,

Russell.

Thanks Russell,

When will this Best Stocks < $3 – 50,000 appear as a model portfolio under the portfolio tab? It wasn't there last night.

What criteria did you use to select stocks to buy from the Best Stocks < $3 – 50,000 search? Did you use the automatically replace closed positions facility at all times?

Regards

John

Hi John,

I have not updated the new UniSearch yet – I am still in the testing phase and seeking feedback. This search is looking good post 2012 but warrants a bit more testing.

For the settings – the positions are automatically replaced provided that the GLB/RT Kicker signal is in place.

Regards,

Russell.

Hi Russell

Comments below are probably more to do with my bias to conservative but I’d consider:

1. Changing the ‘Stock AvVol’ field to ‘Stock Price * AvVol’ – to automatically take into account the dollar size of the trade rather than just the volume.

2. Adding a field ‘Industry RT Ranking < 30' to limit the industries canvassed to those preforming better than average.

Cheers …….. Alan

Hi Alan,

I have just revised portfolio – per the latest blog post (as of today) – I have limited the maximum industries to 2 and maximum sectors to 2 out of 10 possible shares to ensure diversification. In addition, I have cut the maximum purchase to no more than 5% of a shares volume In addition, I have ensured no penny stocks are picked up. This should address the above – I can refine further if required. My audit per the revised portfolio is showing that the stocks picked up are at reasonable levels and there is plenty of liquidity in terms of trades and dollars for the given day.

Regards,

Russell.