Market direction is the single most important thing that an investor needs to know.

If we’ve said it once, we’ve said it a thousand times, VectorVest believes that market direction is the single most important thing that an investor needs to know. The market has been brutal for investors that weren’t prepared, but not for the VectorVest subscribers that have been tuned in and paying attention to our market guidance. The information we provide is not based on our best guess; it is based on actual information, data and trends. That’s how we expertly time the market.

Spotting trends has never been easier! VectorVest’s powerful market timing system tells you exactly when to take your profits off the table, and when it’s safe to buy stocks.

In November 2021, I knew to sell almost all of my stocks and went to cash, right before the crash. And this wasn’t lucky timing. I received advance notice that the crash was coming. This signal alone saved me thousands of dollars…just as the market plummeted.

There is no better way to protect your portfolio in a down market than going to cash, but you must know when to sell. You can see my portfolio is flat from November to March, while the NASDAQ dropped -20%.

You see, I have what you’d probably call an unfair advantage when it comes to investing. No, I don’t use a money manager or anything like that. Like many investors, I manage my own portfolio.

But thanks to VectorVest, the volatile market activity we’re seeing right now doesn’t ever cause me to lose a minute of sleep. VectorVest has signaled every major market move for the last 25 years, WITHOUT FAIL.

VectorVest has seen it all before, alerting investors to:

- The devastating crash of 2007 – 2008

- The explosive rally of 2009

- The summer sell-off of 2015

- The worst January since 2009 (2016)

- The Post-Election Rally of 2016-2017

- The two largest daily Dow point losses in history of February 2018

- The Coronavirus Crash of 2020

- And the current Wall Street sell-off

Get the VectorVest advantage!

Or call 1-888-658-7638

Expertly Time the Market

Some investors believe that the market moves in a random fashion, we don’t believe that’s true. In fact, with 25 years of experience successfully identifying market turning points, we know it’s not true.

The talking heads on TV have no problem falsely predicting what the market is going to do based on day-to-day movement, but claim that you can’t time the market, that’s also not true. The truth is that no one can predict the market, but you can identify changing trends and that is what VectorVest does, we time the market, and we do it well.

We have developed four exclusive indicators specifically designed to identify market turning points. The Price of the VectorVest Composite, VVC, the Relative Timing (RT) of the VVC, the Buy/Sell Ratio (BSR) and the Market Timing Indicator (MTI).

Using these indicators, we track, analyze, and identify market direction. The analysis allows us to sense turning points in the market. The Market Timing Gauge on the Home Page provides an instantaneous visual representation of market direction.

From there, VectorVest prepares our subscribers for whatever the market gives us and allows them to use our systematic approach to make money in the market, no matter what direction it’s moving.

We’re not just blowing smoke; all the proof is in the VectorVest system. Go back and see for yourself. We warned our subscribers to take profits on March 10, 2000, at the top of the tech bubble, to go long on March 21, 2003 at the bottom of the market, warned of the impending bear market on November 2, 2007 before the housing collapse, and to go long March 6, 2009 when the bull run started.

In 2020, before the Coronavirus crash, we began warning subscribers to protect profits on January 17, 2020, and then alerted them to buy stocks long, just two days after the bottom, on March 25, 2020. What more could any investor ask for?

Get the VectorVest advantage!

Or call 1-888-658-7638

How to Protect Profits

As VectorVest’s timing indicators begin to sense a market downturn, our educational team begins preparing customers for the volatility that often follows. Using Protective Stop-Loss Orders is a very important first step.

VectorVest’s creator, Dr. Bart DiLiddo, wrote about Stop-Loss orders in Chapter 10 of his book, Stocks, Strategies and Common Sense. He created the VectorVest Sell Recommendation so subscribers would have a clear answer for When to Sell.

We also provide resources and education on a myriad of other techniques to preserve your portfolio, and tools within VectorVest to make this as easy as possible.

VectorVest will always show you how to protect profits in our weekly newsletter, The VectorVest Views, the daily Enhanced Color Guard Video, our weekly Special Presentations, and of course our Educational Courses. In this way, you will never be alone when you need us most.

Making Money in a Down Market

Many investors believe that short selling is best left to aggressive investors who aren’t afraid to take big risks. However, with VectorVest in your corner, that’s no longer true. Now, you can profitably short stocks without taking big risks. And it’s easier than you might think.

If you want to make money in both up and down markets, you need to take profitable advantage of short selling. And even if you’re a cautious investor, you can make money fast with shorting if you follow some simple rules.

First, you need a short-selling strategy that works.

VectorVest has you covered here too. There are dozens of searches that find stocks perfect for shorting.

Pro tip: Short-Sell risky, over-valued stocks with negative earnings and a VectorVest Sell Recommendation.

Here’s a tried-and-true shorting search called Doug’s Downers Supercharged. It was created by—you guessed it—Doug, a VectorVest subscriber, and it works in a variety of down markets.

Here’s what he said about creating it: “I must admit that I am uncomfortable shorting companies with good earnings. These guys can skyrocket at any time. So, I have created a strategy for finding sell-rated stocks with negative earnings in a downtrend.”

With just a few clicks of the mouse, VectorVest reveals a list of stocks that match Doug’s criteria, with the worst (the best shorting candidates) appearing at the top.

What kind of results can you expect from Doug’s Downers Supercharged? Well, if you’d put it into play in November, when VectorVest signaled a Confirmed Market Down, you would have made a profit of 93.05% in just 6 months!

Doug’s Downers Supercharged is just one of many shorting strategies and Contra ETF strategies that help you make money in a down market.

| Shorting Strategy | Performance |

|---|---|

| No Mo MoJo | 70.81% |

| Stinky Stocks to Sell Short | 69.70% |

| Odd Fellows Short | 67.45% |

| Show Me the Money Short | 65.71% |

| Short Sellers | 63.57% |

| High AvgVol Contra ETFs | 49.18% |

| Bottom Fishing for Contra ETFs | 42.25% |

Making Money in Up and Down Markets

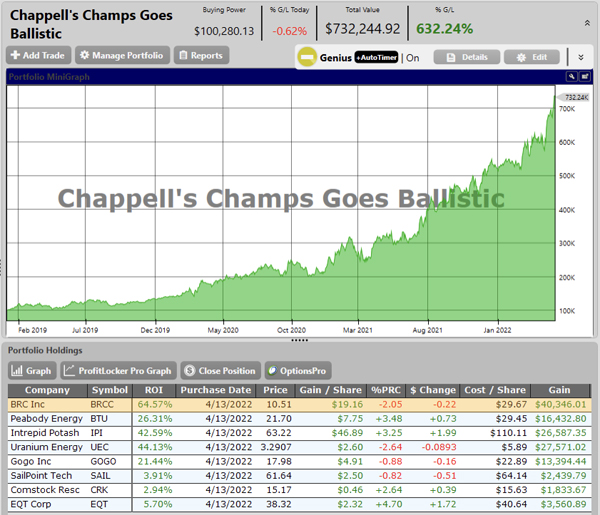

VectorVest has built-in, complete trading systems for making money in both up and down markets. One great performer that is designed for volatile markets is called Chappell’s Champs Goes Ballistic. It was created by Steve Chappell, VectorVest’s Director of Trading System Development.

Here’s what Steve said about creating it, “I wanted a consistent performer that took advantage of market corrections, while focusing the buying when markets are low and rising. I wanted to make money on the short side quickly, while carefully managing the positions. I’m happy with the reasonable drawdown (11.9% currently) relative to the overall performance.”

Steve used the Chappell’s Champs strategy to buy stocks long and Ballistic New Highs-Short to sell stocks short in this trading system. He emphasized that you would not always be fully invested, based on the money-management in the trading system.

With just a few clicks of the mouse, you can use Chappell’s Champs Goes Ballistic or any of over 90 performance-ranked complete trading systems built-in to VectorVest.

What kind of results can you expect from Chappell’s Champs Goes Ballistic? Well, if you’d put it into play in January, you would have made a profit of 31.95%! It’s one-year performance is 106.89%…and over three years you would be up 532%!

Put the power of VectorVest’s complete trading systems to work for your portfolio.

For more about smart ways to sell short, be sure to get your FREE copy of our Special e-Report, How to Short Stocks with Confidence and Make Big Money in Bear Markets. It’s a $16.95 value, yours FREE with your Risk-Free 30-Day Trial of VectorVest!

With this Special Trial Offer, you’ll get this Double Bonus:

- A FREE copy of the classic E-book, Stocks, Strategies & Common Sense, 2022 edition— a $24.95 value

- Chapter 13 is all about stop-prices. It details how they help you control losses and protect profits.

- Successful Investor Quick Start Video Course – a $95 value

You will also receive:

- 30 days of full access to VectorVest 7

- The 4.6 star-rated VectorVest Mobile App — a $19.99 value

- Hot Stock Picks in our Daily Color Guard Video

- FREE, friendly support from our NC staff

- Convenient on-demand learning center—VectorVest University

- FREE, Getting Started Coaching Session—a $95 value

- 100% Money-Back Guarantee

Or call 1-888-658-7638

Does your stock service have customers that have been with them for 25 years and more? Have they worked with OVER A MILLION CLIENTS over the last 30 years?

Do they have the resources to analyze over 18,000 stocks every day in markets including the United States, Canada, Europe, the United Kingdom, and Australia? If not, maybe it’s time to give VectorVest a try. The trial is Risk-Free. What do you have to lose?

What our customers are saying…

“This service that you provide is ABSOLUTELY amazing and EXTREMELY insightful!! Don’t even consider not continuing this most insightful commentary – can’t wait for tonight’s review. Thank you.”

—W.S., Brookfield, WI.

Leave A Comment