After a tough 2022 for Shopify, it appears things are headed back in the right direction – and analysts at Deutsche Bank have taken a strong bullish stance on the stock. What are they seeing that caused them to change their rating for SHOP from HOLD to BUY? And, is now the time for you to buy this stock as well? We’ll answer these questions below.

Despite recession fears, analysts feel that Shopify has bottomed out and rebounded over the past few months. Both revenue and profit are growing. And from a stock analysis standpoint, it appears that there is plenty of room for SHOP to grow in value based on the nearly 50% drop it experienced in the last 365 days.

However, the analyst in question from Deutsche Bank – Bhavin Shah – has really high hopes for the stock. He raised his price target from $40 to $50 – implying a 23%+ gain on the horizon. His reasoning is the migration of major brands to Shopify from other platforms. Two brands in particular he referenced are Supreme and Mattel – both leaders in their respective spaces.

Moreover, Shah points to decreasing operating costs in the near term for Shopify as evidence the stock is primed to go on a bull run. However, he also recognizes a few factors at play that could influence his projection. These include a deeper recession, additional corporate spending, and brands choosing to sell on Amazon over Shopify.

We’ll know more about what Shopify can do over the next few weeks as Q4 earnings are set to be reported in February. However, in the meantime, is there enough evidence that you should buy SHOP now?

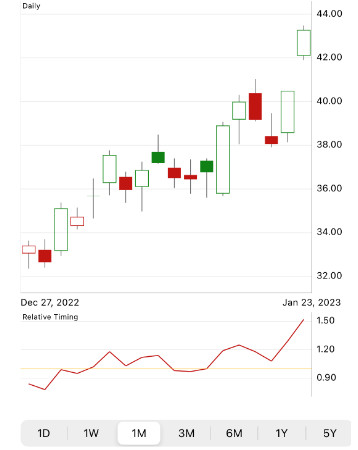

In the past 3 months, the stock has grown over 45%. Today alone the stock is up almost 7%. There’s no denying the price trend that has formed for SHOP. But, there is one major issue we see when taking a look at the stock through VectorVest’s stock analysis software.

Despite Excellent Timing, SHOP Has Very Poor Upside Potential

The VectorVest system makes finding and vetting opportunities in the stock market simpler and faster. And, it helps you eliminate guesswork, emotion, and human error from the equation – so you can keep your losses smaller and more infrequent while earning better returns.

It’s all possible through the proprietary stock rating system we’ve developed. Instead of tracking countless technical indicators, you’re told everything you need to know in just three ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

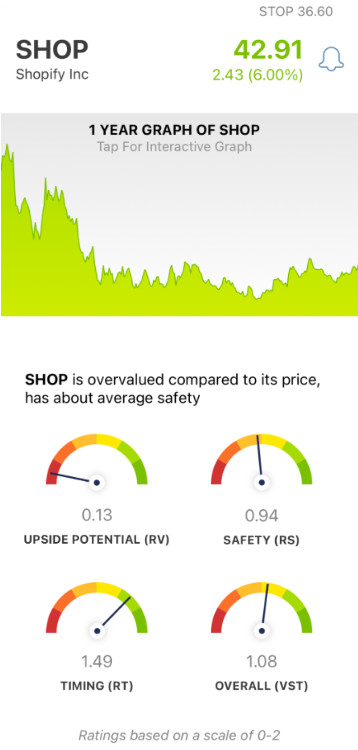

These ratings are easy to interpret as they sit on a scale of 0.00-2.00. Ratings over the average of 1.00 indicate overperformance and vice versa – and the best part? Based on the culmination of these three ratings, VectorVest provides a clear buy, sell, or hold recommendation for any given stock at any given time. As for SHOP, here’s what you need to know:

- Very Poor Upside Potential: The RV rating assesses a stock’s long-term price appreciation potential compared to AAA corporate bond rates and risk. And right now, the big problem with SHOP is the very poor RV rating of 0.13. Moreover, the stock is way overvalued – with a current value of just $5.92.

- Fair Safety: In terms of risk, SHOP is fairly safe – with an RS rating of 0.94, just below the average. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The positive price trend SHOP has developed over the past few months is continuing to strengthen – and the excellent RT rating of 1.49 reflects that. It’s calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All this works out to an overall VST rating of 1.08 for SHOP – which is fair. Is it enough to earn the stock a buy recommendation, though? Or, should you wait to see what happens on the upcoming earnings call? Don’t miss this opportunity – you can get a clear answer on your next move through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, SHOP has very poor upside potential and is overvalued. It does have fair safety and excellent timing, though.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment