By Leslie N. Masonson, MBA

Perdocoe Education Corporation (PRDO) is a Nasdaq-listed firm headquartered and incorporated in Schaumburg, Illinois in 1994 with 2,400 employees. It was formerly known as Career Education Corporation when the name was changed in January 2020.

The company offers postsecondary education to almost 34,000 individuals using three approaches: online, campus-based, and blended learning to their U.S. clients. Academic offerings include: business and management, nursing, healthcare management, computer science, information systems and technology, cybersecurity, and criminal justice, among others. Moreover, PRDO operates the Intellipath personalized learning platform.

Currently, the company has 65 million shares outstanding. PRDO has reported trailing 12-month earnings per share of $1.86 which grew 19% in the past year. Its market capitalization stands at $1.18 billion, and it pays a 2.48% dividend.

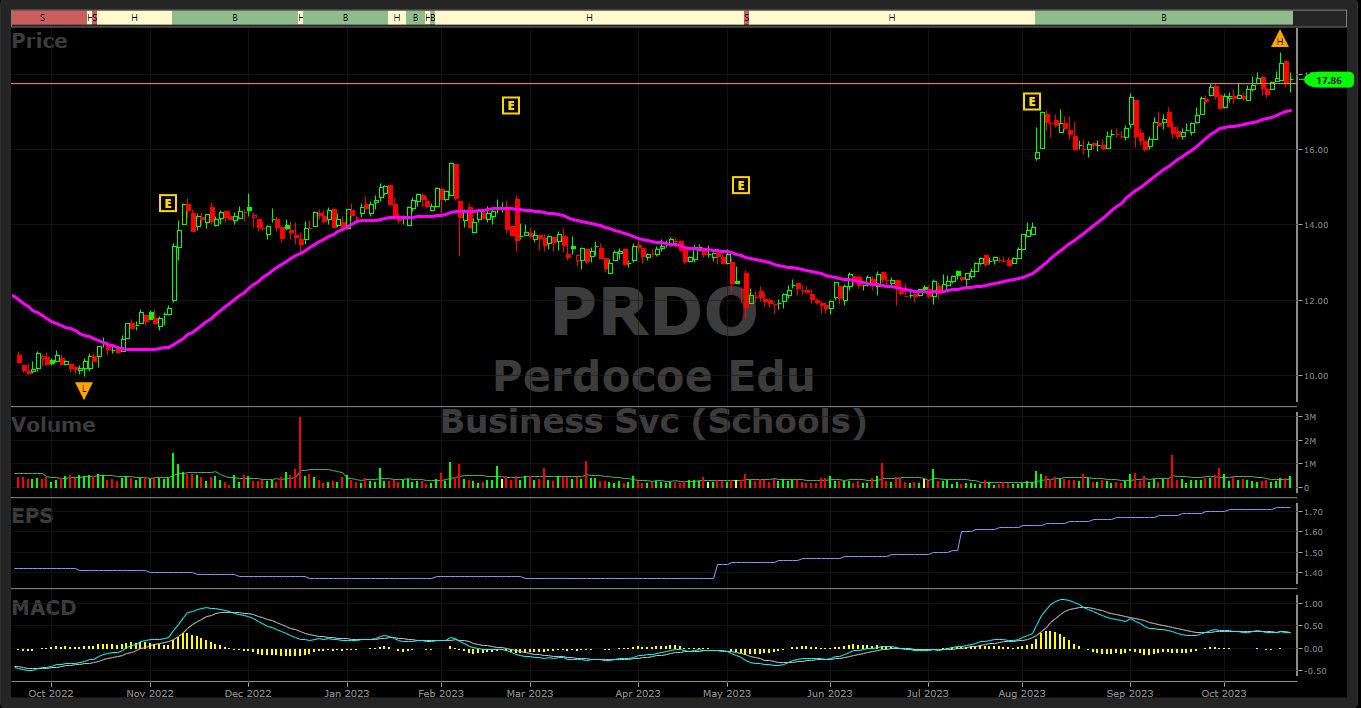

The stock’s all-time high was $70.78 on June 10, 2004, and all-time low on April 19, 2010 at $2.10. In more recent times, the last low was on March 18, 2020 at $7.11. Between September 2020 and November 2022 (see chart below) its price was in a trading range of $9.65 to $13.87. The stock broke out for a few days before trending sideways to down until August 4, 2023 when it had a huge gap up, but not on big volume and has drifted higher ever since hitting a high of $18.58 on October 18. Clearly, the improved earnings report and trend has accelerated its move higher.

This small-cap firm has a 315 institutional following which is impressive for a company without a big retail investor following. With 94% of the shares owned by institutions, and 1.5% owned by insiders. Blackrock owns a significant 17% of the shares, followed by Vanguard’s 13%, and Dimensional Fund Advisors 8%. When these big institutions have a decent size share position that is a definite plus and represents a strong commitment by the big players to the shared future potential.

PRDO is situated in VectorVest’s Business Services (Schools) category and holds the #1 VST position among 30 companies. More impressively, it also maintains the #1 position in the broader Business Services, which comprises a massive 280 companies. This is particularly noteworthy, considering that the group itself is only ranked 78th in Relative Timing (RT) out of 222 tracked industries, signifying a slightly above-average ranking. A stock that is significantly outperforming its group, like PRDO, should be evaluated to determine if it can continue to have its “Buy”rating continue. Therefore, let’s check out its VectorVest metrics.

Perdocoe Offers Solid Metrics, Is Undervalued by 24% and Near Recent High

The VectorVest software issues buy, sell, or hold recommendations on 9,154 stocks/ETFs. This proprietary stock rating system splits the data into three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each is measured on a scale of 0.00-2.00, with 1.00 being the average for quick and easy interpretation, and 2.00 being the best.

As for PRDO, its current metrics are as follows:

- Very Good Upside Potential: The Relative Value (RV) rating focuses on the stock’s long-term, three-year price appreciation potential. PRDO currently holds an RV rating of 1.33, which is well above average. The current stock price is $17.86, and VectorVest places its value at $22.19, indicating that the stock is considerably undervalued with a significant upside potential of 24.2%.

- Good Safety: The Relative Safety (RS) rating is based on the company’s business longevity, financial predictability/consistency, debt-to-equity ratio, and additional risk parameters, including price volatility. Its RS rating of 1.13 is above average, which makes it suitable for conservative investors.

- Excellent Timing: The Relative Timing (RT) rating focuses on the price trend over the short, medium, and long term. The components include price direction, dynamics, and price magnitude of price changes over daily, weekly, quarterly, and yearly comparisons. PRDO boasts an exceptional RT rating of 1.48, well above the database average of 0.75. This indicates that the stock has consistently outperformed across various timeframes.

- Good Comfort Index: This index measures the consistency of a stock’s long-term resistance to severe and lengthy corrections. This index compares the individual stock to the fluctuation of the VectorVest Composite price. PRDO’s rating of 1.17 is slightly above average. This reading also indicates that it would be suitable for conservative investors, as was the Safety Rating above.

- Good Growth Rate (GRT): PRDO’s current sales growth rate over the past 12 months has been 11%, with a reasonable forward-looking earnings growth rate of 14% (measured over a forecasted three-year period). These two factors, among many others, are captured by the VectorVest software. Therefore, you can quickly get a picture of the company’s fundamental measurements with a few mouse clicks.

- Very Good VST Score: The VST Master Indicator ranks all stocks from high to low with those stocks with the highest VST scores at the top of the list. PRDO’s’s VST is 1.33, which is well above average. The VST enables subscribers to quickly identify stocks that are performing much better or worse than the average, and PRDO is clearly an above average performer.

Conclusion

Since early August the stock has risen from $14 to $18 in a tight uptrend, as the overall markets have tanked. In the week ending October 20 the stock gained 2.3% with a declining market in comparison. Therefore, it has positive relative strength and will most likely be higher from here. A stop order at $14 will protect principal, if a position is taken above that level.

There is an upward earnings trajectory, and the average daily trading volume of 108,000 shares provides sufficient liquidity. Please note that there is a spread of between 1% 2%. However, this is common for lower-priced stocks with less than one million shares traded daily. The stock is above its rising 40-day moving average, but the MACD has flattened. A negative MACD crossover would be a cautionary note. If you decide to purchase this stock, consider using a price limit order between the bid-to-ask prices to get a better execution. Currently, the Daily Color Guard warns not to buy stocks at this time. Therefore, place this stock on a watchlist and watch the Views to stay on the right side of the market.

If you're not a VectorVest subscriber, consider the $9.95 30-day trial to track the stock’s price movements along with the VectorVest signals.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment