By Leslie N. Masonson, MBA

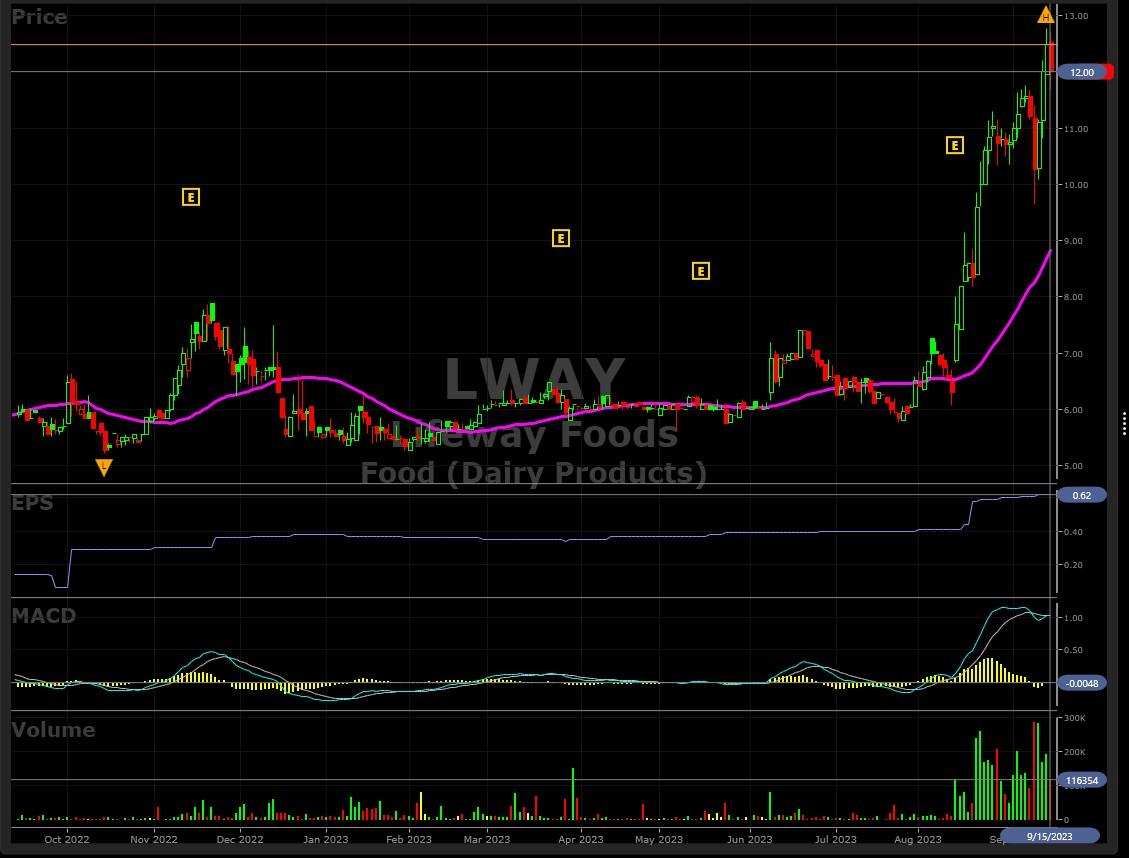

Lifeway Foods (LWAY) stock price has surged 91% since August 11 and 16.8% this past week on exploding volume. This highly-rated stock should be placed on investor watchlists for a possible continuation of its price momentum going forward. But be cautious in the recent 10-day downtrending market.

Lifeway Foods, Inc. is a Nasdaq-listed firm that was incorporated in Morton Grove, Illinois, in 1986 and has 289 employees. There are 14 million shares outstanding. Revenues totaled $151 million, and LWAY’s market cap is $176 million.

The company provides fermented probiotic-based goods to the United States, as well as to global consumers. Its main product is drinkable kefir, a cultured dairy product in various organic and non-organic flavors. Moreover, the company also produces European-style soft cheeses, and its products are sold under various brands, including Lifeway, Glen Oaks Farms, and Fresh Made, as well as under private labels using a direct sales force, brokers, and distributors.

Most investors are probably not familiar with this small-cap company, nor has it attracted the attention of institutional investors. The stock has a minimal following of 31 institutions, owning only 11% of the outstanding shares, while insiders own a staggering 75%. These two percentages are usually reversed, so the fact that institutions are not yet paying much attention to this stock could limit the upside momentum, as they have the cash to buy up shares and push the price higher.

Zack’s rates the stock an excellent momentum play, and Simply Wall St. sets its fair value at $13.70, which is $1.70 above its Friday closing price of $12. Moreover, LWAY announced on August 14 record results for the quarter ended on June 30, 2023, and the stock catapulted higher, as seen in the accompanying chart.

Various mutual funds hold 1% shares or less, and a few institutions like Renaissance Technologies, LLC (a hedge fund) own 2.6%, Dimensional Fund Advisors LP owns 1.5%, and Vanguard Group owns 1.80%, all very small positions.

Looking at the chart again, it shows the explosion in price and volume after its latest earnings report on August 14. The high volatility and wide price ranges need to calm down now and base for a while to be a viable candidate going forward. With a Beta of 1.43 (the stock price is 43% more volatile than the market), this stock is suited only for aggressive traders and investors.

LWAY resides in VectorVest’s Food (Dairy Products) grouping and is rated #1 out of 3 companies. Moreover, it is also ranked #1 in the broader Food sector out of 226 stocks, which is even more impressive. Note that the Group itself is ranked #2 in Relative Timing (RT) out of 222 tracked industries, an extremely favorable showing. When a stock is also in a highly-ranked group, as LWAY currently is, that is a big plus, as similar stocks move together as a herd.

LWAY Displays Three “Excellent” Metrics, Is Fairly Valued and Has Been a Top Market Performer Since August 11

The VectorVest software issues buy, sell, or hold recommendations on all 9,168 stocks and ETFs tracked. This proprietary stock rating system breaks down the data into three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each is measured on its own scale of 0.00-2.00, with 1.00 being the average for quick and easy interpretation, and 2.00 being the best.

As for LWAY, its current metrics are as follows:

- Very Good Upside Potential: The Relative Value (RV) rating focuses on the stock’s long-term, three-year price appreciation potential. LWAY currently holds an RV rating of 1.27, which is slightly above average. The current stock price is $12.00, and VectorVest places its value at $12.10, indicating that the stock is fairly valued with limited upside potential.

- Fair Safety: The Relative Safety (RS) rating is based on the company’s business longevity, financial predictability/consistency, debt-to-equity ratio, and additional risk parameters, including price volatility. Its RS rating of 0.90 is below average, indicating above-average risk, which makes it a risky candidate for conservative investors.

- Excellent Timing: The Relative Timing (RT) rating focuses on the price trend over the short, medium, and long term. The components include price direction, dynamics, and price magnitude of price changes over daily, weekly, quarterly, and yearly comparisons. LWAY has an exceptionally high RT rating of 1.93 compared to the average of 0.88 for all the stocks in the database, which means that the stock has been a superior performer over multiple timeframes. Recall that a perfect RT score is 2.00, and that only five other stocks in the 9,168 universe have a higher score than LWAY which means that this stock is a “needle” in the haystack, as far as timing is concerned.

- Good Comfort Index: This index measures the consistency of a stock’s long-term resistance to severe and lengthy corrections. This index compares the individual stock to the fluctuation of the VectorVest Composite price. LWAY’s rating of 1.24 is above average. A higher reading would have been better for conservative investors, but that is not the case here.

- Excellent Growth Rate (GRT): LWAY’s current sales growth rate over the past 12 months has been 17%, and its forward-looking earnings growth rate is 28% (measured over a forecasted three-year period), which are both very solid fundamentals. These two factors, among many others, are captured by the VectorVest software. Therefore, you can quickly get a picture of the company’s fundamental measurements with a few mouse clicks.

- Excellent VST Score: The VST Master Indicator ranks all stocks from high to low with those stocks with the highest VST scores at the top of the list. LWAY’s VST is 1.47, which is well above average. Moreover, this stock is ranked #6 in VST out of 9,168 in the VectorVest database which means it is in the top 6/10th of 1% of all stocks, quite an achievement. Using VST enables subscribers to identify stocks that are performing much better or worse than the average, and LWAY is clearly in the former category.

In conclusion, LWAY's exceptional metrics, including its rapid rise in the Stock Viewer ranking from around 200 a month earlier to a top 6 position, have the potential to propel the stock price much higher. However, VectorVest's metrics have determined it to be fully valued, so caution is advised.

The earnings trend is on an upward trajectory, and the average daily trading volume over the past 24 trading days has been 131,000 shares, which is 10 times that of the prior month's volume. This indicates increasing interest from retail traders, but institutions have not shown significant interest.

If you decide to purchase the stock, be sure to place a stop-loss order at a comfortable level below your purchase price. Currently, the stock price sits 36% above its 40-DMA, which means that it is very extended, so caution is advised.

Although the MACD is still positive, it needs to be watched, as another down day would result in a negative crossover. This is not a good time to jump in due to the concerns just mentioned. A better opportunity, if it arises, would be a decline to the $10 area followed by a reversal higher.

If you're not a VectorVest subscriber, consider the $9.95 30-day trial to confirm that both the VectorVest Daily Color Guard and LWAY stock are giving 'BUY' signals before taking action.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment