Shares of iRobot (IRBT) are up more than 39% Friday morning as rumors are gaining traction that Amazon will gain approval in the EU to take over the company.

This is something that the world’s largest e-commerce giant has been working on for a while, as the deal was first announced back in August of this year.

The big ticket item here is iRobot’s Roomba smart vacuum, which learns your home’s layout and cleans floors automatically. This product will be a perfect addition to the rest of Amazon’s “Smart Home” lineup – which already includes the likes of Alexa, smart thermostats, security devices, and more.

Amazon is always scrutinized by antitrust enforcers when it attempts to acquire another company, and the European Commission voiced its concern over the deal in reducing competition for robot vacuum cleaners.

While the EU Commission was set to give its verdict by February 14 2024, multiple people have confirmed that the deal has gained approval – now, it’s just a matter of when the verdict will be released. Both the EU Commission and Amazon declined to comment on the matter.

The $1.4 billion acquisition is a massive premium compared to iRobot’s opening stock price this morning – but as this news has gained traction, IRBT has skyrocketed.

Now, whether you currently own shares of this stock or are interested in riding the hype, it’s important to understand that these are nothing more than rumors for the time being.

So, we’ve taken a look at IRBT through the VectorVest stock analysis software to get a better sense of the current opportunity in this stock beyond the potential acquisition. We’ve uncovered 3 things you need to see before you do anything else.

IRBT HAs Very Poor Upside Potential and Poor Safety, But Excellent Timing Pushing the Stock Price Higher

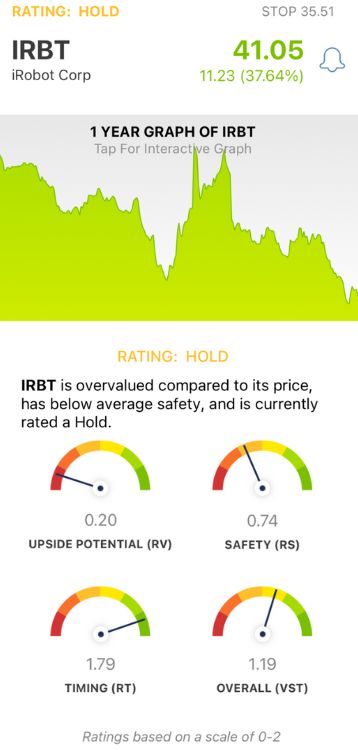

VectorVest simplifies your trading strategy by giving you clear, actionable insights in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

This saves you time and stress while empowering you to win more trades. But it gets even easier, as you’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for IRBT, here’s what we found:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. It offers far superior insights than a simple comparison of price to value alone. IRBT has a very poor RV rating of 0.20, suggesting the stock is way overvalued.

- Poor Safety: The RS rating speaks to a stock’s risk. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and more. As for IRBT, the RS rating of 0.74 is poor.

- Excellent Timing: The one thing this stock has going for it is hype and momentum pushing its price higher - and the RT rating of 1.79 reflects its performance so far today. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.19 is good for IRBT, but VectorVest has placed a HOLD recommendation on it for the time being. You can learn more about the current situation for this stock or the VectorVest system itself by getting a stock analysis free today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. IRBT is making headlines right now as rumor has it the EU Commission will approve the Amazon acquisition. While the stock does have excellent timing right now, it has very poor upside potential and poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment