G-III Apparel Group (GIII) got a nice boost in Thursday morning’s trading session after the company’s earnings beat out the analyst consensus. This was coupled with the announcement of a landmark deal with Champion.

G-III operates a myriad of fashion and apparel brands like DKNY, Karl Lagerfeld, and Wilsons Leather. The parent company did see a big drop in net income for the fiscal second quarter. The figure fell from $36.3 million this time last year to just $16.4 million. But, this was the only negative news for the day.

The company saw sales climb 9% to $659.8 million, which easily exceeded the consensus of $591.4 million. And, earnings of 40 cents (excluding nonrecurring items) were a slight improvement from the 39 cents last year, and dramatically higher than the 1 cent Wall Street was expecting.

It’s expected that this trajectory will continue, as G-III is forecasting $3.3 billion in sales for fiscal 2024 coupled with an EPS in the range of $3.05 and $3.15. Previously, the company had laid out guidance of just $3.29 billion and EPS of $2.65-$2.75.

Beyond the financial side of things, the company’s stock soared on the news of securing a Champion deal. The company will now be able to produce officially licensed outwear under the Champion Brand, which has become well-recognized and sought-after for both quality apparel and fashion.

Shares jumped as much as 24% in pre-market trading, but since the morning trading bell sounded, the stock is up around 19%. That being said, should you trade this stock and ride the hype?

Not so fast. We’ve taken a look through the VectorVest stock analyzing software and found 3 things that you’re going to want to see before you make your next move.

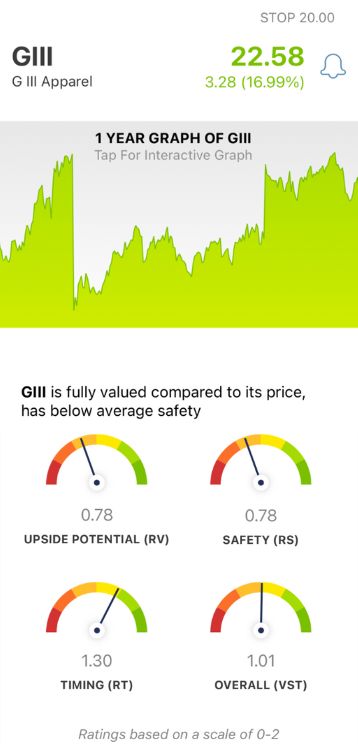

While GIII Has Very Good Timing, Upside Potential and Safety are Poor

VectorVest is a proprietary stock rating that tells you what to buy, when to buy it, and when to sell it. It simplifies your trading strategy and empowers you to win more trades with less work and stress.

You’re given all the insights you need to make calculated decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on an easy-to-interpret scale of 0.00-2.00, with 1.00 being the average.

But it gets even easier. The system issues a clear buy, sell, or hold recommendation at any given time based on the overall VST rating for a given stock. As for GIII, here’s what we found:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. This offers far superior insights than a simple comparison of price to value alone. As for GIII, the RV rating of 0.78 is poor. And, it may not get any better - as the stock is fully valued right now.

- Poor Safety: The RS rating is an indicator of risk. It’s derived from the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. This stock’s safety is poor with an RS rating of 0.78 as well.

- Very Good Timing: The one thing GIII has going for it right now is the strong positive price trend that has been forming leading up to today and solidified by this news. The RT rating of 1.30 is very good, and is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.01 is just above the average and considered fair. But is it enough to justify buying this stock? Or, should you hold off for now and see how things trend over the coming days and weeks?

Don’t play the guessing game or let emotion influence your decision-making. A clear buy, sell, or hold recommendation is just a click away. Get a stock analysis free today to make your next trade with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. The earnings beat and the Champion deal have sent shares of GIII higher and resulted in very good timing - but the stock still has poor upside potential and safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment