General Mills (GIS) reported fiscal first-quarter earnings before the opening bell sounded this Wednesday morning. The results were a mixed bag with positives and negatives, spelling uncertainty for investors as to how to feel about the quarter.

Inflation has been a challenge for many companies, General Mills included, over the past few quarters. However it appears to be leveling out, and as a result, the company was able to grow revenue by 4% year over year to $4.9 billion. This was also possible as the company overcame supply chain hurdles that had been posing a problem.

Though the top line grew, the bottom line struggled. Profits dipped as net margin fell to $673.5 million, or $1.14 per share. This was a big step back from this time last year when the company reported $820 million ($1.35 per share) on even less revenue.

While margin has been a problem for General Mills for a while, the company has been able to raise prices without much resistance to try and offset substantial losses. And, while it couldn’t have been more narrow, the non-GAAP EPS of $1.09 per share did beat out the consensus by a cent.

General Mills plans for the foreseeable future are to continue to improve supply chain efficiency and remain disciplined in how capital is allocated throughout the company. General Mills expects to deliver full-year revenue of $20.62 billion and EPS of $4.47.

The market’s reaction to GIS earnings has been negative so far in Wednesday’s trading session. The stock is down 0.64% but dropped as low as 1.84% at one point. This adds to what has already been a tough few months for investors, who have watched their position fall nearly 20% over the past 3 months.

So, what’s the key takeaway from all this for investors – should you maintain your position or bolster it by picking up more shares? Is it time to sell?

No need to play the guessing game or let emotion cloud your judgment. We’ve uncovered 3 things you need to see through the VectorVest stock analysis software to help you make your next move with confidence.

GIS Has Fair Upside Potential and Safety But Poor Timing

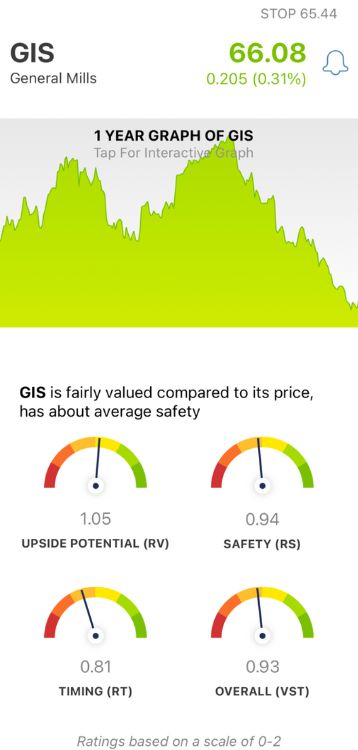

The VectorVest system is based on a proprietary stock rating system that simplifies your trading strategy. You’re given all the insights you need in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00 with 1.00 being the average. Based on the overall VST rating, the system offers a clear buy, sell, or hold recommendation for any given stock at any given time. As for GIS:

- Fair Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential and AAA corporate bond rates & risk. It offers much better insights than a simple comparison of price to value alone. As for GIS, the RV rating of 1.06 is fair.

- Fair Safety: In terms of risk, GIS is a fairly safe stock - despite the RS rating of 0.94 being slightly below the average. This rating is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The biggest issue for GIS right now is the negative price trend that has gripped the stock for a while. The RT rating of .79 is poor. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.92 is a ways below the average but deemed fair nonetheless. So, what does this mean for you as an investor? A clear answer on your next move is just a click away - get a stock analysis free at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Even though the company’s earnings came in above the analyst consensus, the market hasn’t reacted positively to the news. GIS still has fair upside potential and safety, but the timing is poor for this stock right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment