Catalent (CTLT) is all over the headlines this Monday morning as rumors surge of an acquisition. The buyer in question is Danaher (DHR), a company that designs and manufactures diagnostic tools for health, food, and water services. This play is said to be Danaher’s way of competing with Thermo Fisher Scientific.

This marriage makes sense as Catalent specializes in enabling pharma, biotech, and consumer health partners to optimize product development, launch, and full-cycle supply for their patients. But is there anything supporting this rumor?

Danaher’s interest was first reported by Bloomberg – and analysts do believe that from a strategic and financial standpoint, the deal is sound. But long term, they’re not convinced this is the best use of time and resources from Danaher’s point of view.

Experts also question whether this acquisition would truly enable them to compete with Thermo Fisher Scientific. After all, Thermo has a five-year head start in the industry. And, there would still be a need for Danaher to take on a contract resource organization to help get drug approvals in the end.

In looking at Catalent’s performance as a company of late, it’s worth pointing out that the upcoming earnings report could be favorable. This is likely playing at least some role in causing the increase in share price recently. The company is seeing favorable earnings estimate revision activity as the earnings release date approaches. This is an indication they could be set up to beat estimates.

All things considered, you’re wondering if Catalent stock is worth a buy as it’s soared more than 20% after all this news. And we’re here to help you find out – keep reading below to get a clear answer on your next move through the VectorVest stock analysis software.

Does Very Poor Upside Potential Outweigh Excellent Timing for CTLT?

The VectorVest system changes how you uncover and validate opportunities in the stock market. It saves you time while eliminating human error, guesswork, and emotion.

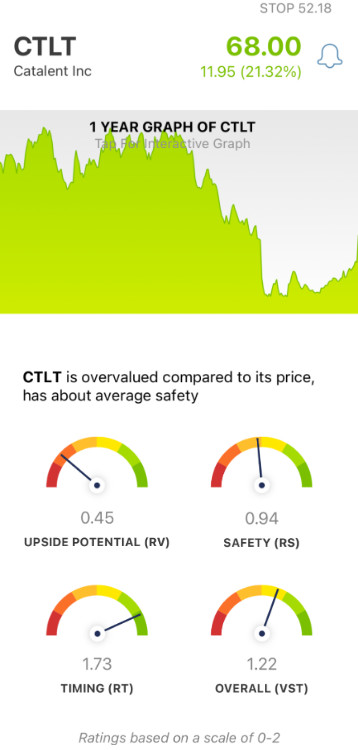

All of this is possible thanks to a proprietary stock-rating system. You’re told everything you need to know in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 for effortless interpretation – pick stocks over the average (1.00) and win more trades!

But it is actually even easier than that – as VectorVest provides a clear buy, sell, or hold recommendation for any given stock at any given time based on these ratings – including Catalent. Here’s the current situation:

- Very Poor Upside Potential: The RV indicator compares a stock’s 3-year price appreciation potential to AAA corporate bond rates and risk – helping you assess the true value of a company. As for CTLT, the RV rating of 0.45 is very poor. Plus, the stock is overvalued right now with a current valuation of just $22.61/share.

- Fair Safety: In terms of risk, CTLT is fairly safe with an RS rating just below the average at 0.94. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The one thing CTLT has going for it right now is hype – and the excellent RT rating of 1.73 reflects that. This rating is calculated based on the direction, dynamics, and magnitude of the stock’s price movement – day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 1.22 – which is good. But does it earn CTLT a buy recommendation? Or should you wait to see how the coming weeks play out in terms of earnings and acquisition? Don’t wait any longer and risk missing this opportunity – get a free stock analysis here to find out your next move!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, CTLT is overvalued with very poor upside potential, but it does have fair safety and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment