Yesterday, Amazon announced its acquisition of healthcare provider One Medical. This landmark deal will cost Amazon $3.9 billion, and allow them to become a primary medical care provider. But so far, the market reaction hasn’t been what Amazon was hoping for.

The purchase of One Medical will grant Amazon access to over 200 brick-and-mortar doctor’s offices and more than 800,000 existing members. This also serves as an opportunity for Amazon to expand its telehealth services, and perhaps more importantly, solidify relationships with hospital systems.

While this deal presents the biggest step yet in Amazon’s healthcare journey, it isn’t the first. The company has its own health services segment and purchased the online pharmacy service PillPack (known as Amazon Pharmacy today) back in 2018. They also attempted to branch out into health insurance alongside Berkshire Hathaway and JPMorgan Chase, but that fizzled out a few years ago.

Upon the announcement of this deal, the FTC said they would not immediately interfere by launching an antitrust suit. But, FTC spokesman Douglas Farrar says their investigation is far from finished.

There is a concern as to how Amazon can use sensitive consumer health information held by One Medical. Because Amazon is an e-commerce company first and foremost, the fear is that they will use this information for more targeted advertising campaigns. And, there is also worry that this deal creates harm to competition.

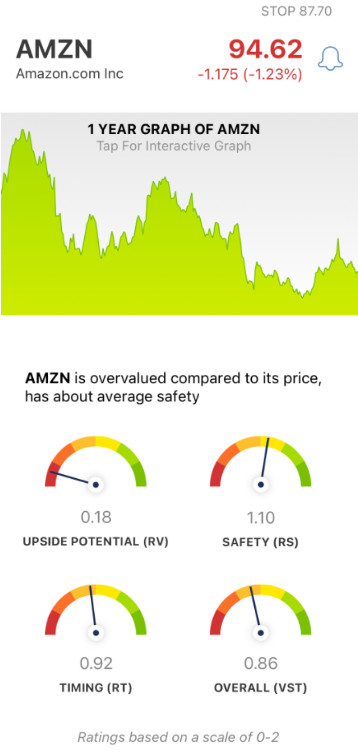

The lingering possibility of FTC intervention could be to blame for the market’s less-than-optimistic reaction to this acquisition. As of 11 AM EST, AMZN is down 1.3%, continuing a trend we’ve witnessed over the past month or so.

This begs the question – is this deal actually a good thing for Amazon investors? We’ll take a look at where the stock sits today through the VectorVest stock analysis software below to help you determine your next move.

Is AMZN Stock Worth Buying, or Should You Wait to See How This Deal Unfolds? Here’s What You Need to Know…

The VectorVest system helps you gain clear insights into any given stock at any given time through a proprietary stock rating system. With just 3 simple ratings, you’re told what to buy, when to buy it, and when to sell it. These ratings are relative value (RV), relative safety (RS), and relative timing (RT).

They sit on a scale of 0.00-2.00, with 1.00 being the average. Interpretation of these ratings is as quick and easy as it gets - just pick stocks with higher ratings and win more trades! Or, better yet, follow the clear buy, sell, or hold recommendation VectorVest offers based on these ratings. As for AMZN, here’s the current breakdown:

- Very Poor Upside Potential: The RV rating gives you accurate insights into a stock’s long-term price appreciation potential by comparing it to AAA corporate bond rates and risk. And right now, AMZN has a very poor RV rating of just 0.18.

- Good Safety: In terms of risk, AMZN has a good RS rating of 1.10 - which is calculated based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: Over the past few weeks, a slightly negative price trend has formed for AMZN - it’s down 3% in the last month, and that trend looks to be continuing today in the first trading session since the deal has been announced. And, the fair RT rating of 0.92 confirms this - which is taken based on the direction, dynamics, and magnitude of a stock’s price movement.

The overall VST rating for AMZN is a ways below the average at 0.86 - but is still fair. So - is it time to buy this stock or sell your shares? Or, should you hold on a bit longer to see what happens in the coming days? Get a clear answer on your next move with a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, AMZN has very poor upside potential and below-average timing, but it does have good safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment