BIG WINNERS IN AI.

Written by: Angela Akers

Besides the Fed’s 25-basis point rate hike, tech’s earnings highs and lows, and a blockbuster January Jobs report, everybody’s also talking about Artificial Intelligence, AI, this week.

At the end of November, the user base of a private company called OpenAI, exploded after it released the prototype for its ChatGPT AI model. Active users topped 100 million in January, just two months into its release, and, according to UBS, that tops TikTok which took 9 months to get to 100 million users, and Instagram which took 30 months.

With that popularity, it’s no surprise that OpenAI released a pilot subscription version of ChatGPT on Wednesday called ChatGPT Plus for $20/month. ChatGPT Plus subscribers get access to ChatGPT “even during peak times,” with “faster response times” and “priority access to new features and improvements” the company wrote. The subscription is only available in the US and rolling out to a waitlist.

What exactly is ChatGPT? Essentially, it is a chatbot, but not just any chatbot, it’s an intelligent, fast, conversational chatbot. According to OpenAI, ChatGPT “interacts in a conversational way. The dialogue format makes it possible for ChatGPT to answer follow-up questions, admit its mistakes, challenge incorrect premises, and reject inappropriate requests. ChatGPT is a sibling model to InstructGPT, which is trained to follow instructions in a prompt and provide a detailed response.”

Microsoft, MSFT, invested early in OpenAI, initially creating a partnership with a $1 billion investment in 2019 in an effort to help with the development of artificial general intelligence. They poured more capital into OpenAI in 2021 and increased their investment once again last month. Microsoft has begun to integrate OpenAI’s GPT-3.5 model (the same model used in ChatGPT) into its products. Backing OpenAI looks like it could be the smartest move Microsoft has made recently as they face staunch competition in Google, Amazon, and Meta. In fact, ChatGPT’s immediate popularity has been widely discussed as a major threat to Google’s AI dominance.

Microsoft’s most recent earnings report missed on both earnings and revenue, so OpenAI is clearly not making a difference in the bottom line yet and only time will tell if this investment will really pay off. Nevertheless, my first instinct is, of course, to see what VectorVest has to say about Microsoft. Looking at a VectorVest Simple Graph of MSFT and adding Value, I can see that MSFT is currently overvalued with a Price of $264.60 per share as of last night’s close and a Value of $171.68. However, a forecasted EPS of $9.58 is higher than last February 2nd’s reading of $9.28 per share, which is good.

Adding, Relative Value, RV, and Relative Safety, RS, to the graph, I see that on Feb. 2nd, MSFT’s price appreciation potential is about the same as investing in a AAA Corporate Bond over the next 3 years with an RV of 0.99. But it does have above-average safety with an RS reading of 1.24 and its short-term price is up, evidenced by a Relative Timing, RT, reading of 1.14. Remember, these three indicators are measured on a scale of 0.00 – 2.00, with values above 1.00 being favorable and values below 1.00 being unfavorable.

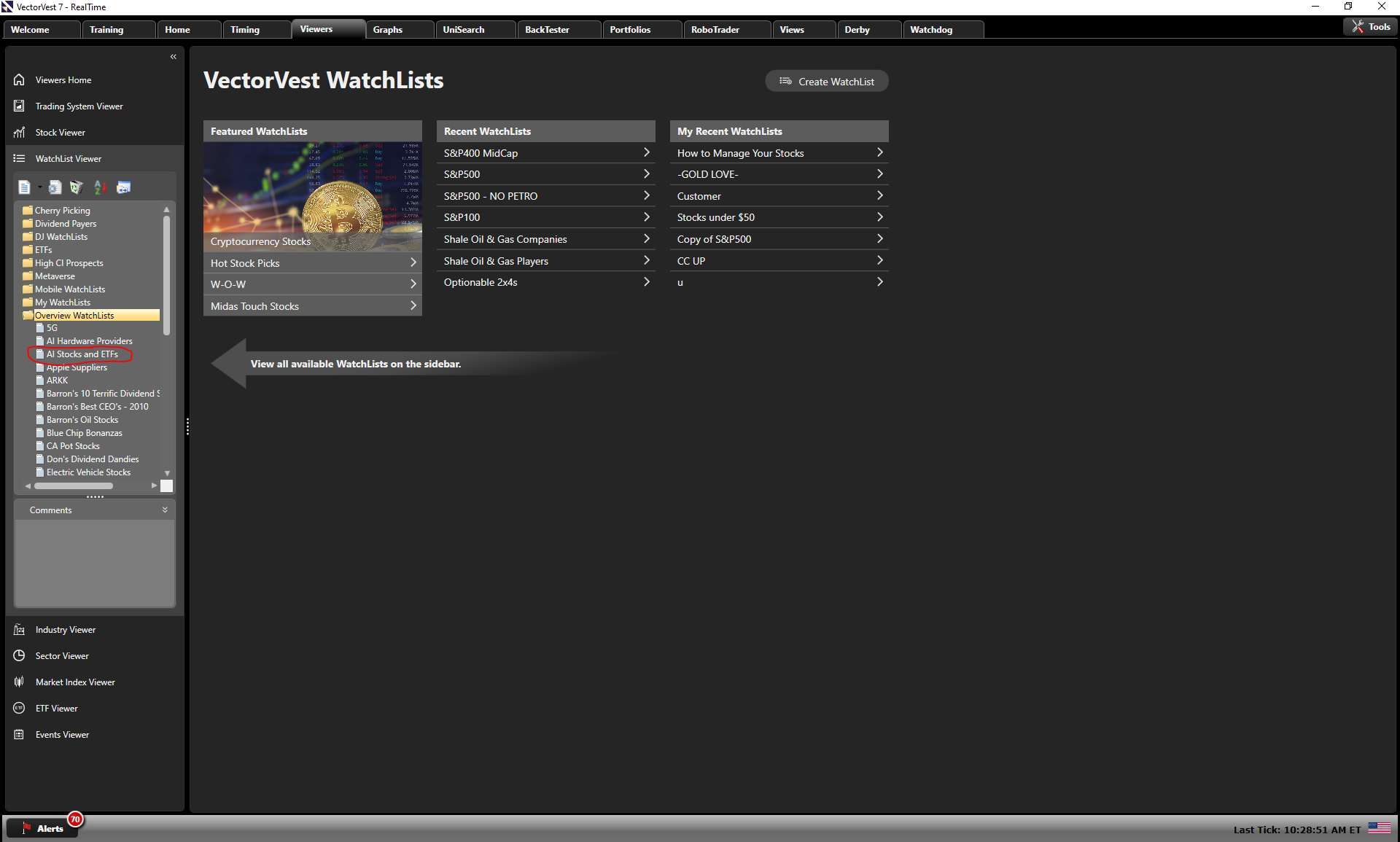

While Microsoft looks ok, I wondered if there were better AI options for me to consider so I did some research and put together a WatchList. The WatchList contains a combination of stocks and ETFs that are involved with AI. I added it to the OverView WatchList Group and named it AI Stocks and ETFs for your perusal as well.

I went back to January 9, 2023, when we received our most recent Confirmed Up, C/Up, signal and ran some QuickTests through last night’s close sorting by various VectorVest proprietary indicators.

Here is what I found:

| SORT | Winners | Losers | % Gain/Loss |

|---|---|---|---|

| VST | 9 | 1 | 16.72% |

| RV | 10 | 0 | 20.20% |

| RS | 10 | 0 | 26.21% |

| RT | 8 | 2 | 12.30% |

| GRT | 10 | 0 | 33.28% |

| CI | 9 | 1 | 12.02% |

Sort this WatchList by the indicator that aligns with your investment style. No matter the sort, if you’re using VectorVest’s proprietary indicators and analysis, you’ll easily be able to find the Big Winners In AI.

Special Note: The weekly US SOTW Q&A has been moved to an All-New Weekly Market Update which will take place on Tuesdays at 12:30 PM ET. You don’t want to miss it! To register for this webcast, please CLICK HERE. Space is limited

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment