THE POWER OF STICKING TO YOUR TRADING PLAN – THE 10 STOCK MODEL PORTFOLIO CASE STUDY.

Written by: Robert and Russell Markham

The temptation for new investors is to panic, sell out and walk away when their portfolios are not working out. Is this the course of action we should take? This will depend on the level of work you have put in. Do you have a trading plan? Have you tested that trading plan? Have you put in a bit of time to refine your trading plan? If you do not have a trading plan in place, then how could one possibly know what to do.

Sadly, too many investors do not put much time into their investing plans, as a guess, I would say most investors do not have a trading plan of any sort. They wake up each day not really knowing what they are going to do. Waking up each day, concerned about the market and not knowing what to do, leads to stress!

Remove the stress…set yourself a trading plan. Not just any trading plan, a trading plan that you have stress tested and are happy with. I recall back in 2017, we started the initial testing for the 10 Stock Model Portfolio as it is called today. You can check out the 10 Stock Model Portfolio early building blocks as documented on our blog (www.vectorvest.com.au/blog). I documented what I was testing at the time. The reason I am going to pick on the 10 Stock Model Portfolio today is that I want to demonstrate the power of developing and testing/refining your trading plan.

Per the VectorVest Australia blog archives, back on 13 June 2017, there is a blog post entitled, “Growth Portfolio – 10 Share Portfolio.” Please CLICK HERE to access that post.

Back in 2017, I had written “For a growth portfolio – I believe it would be beneficial to also have the option to consider a 10 share portfolio – whereby one can diversify across further industries and sectors due to more shares in the portfolio and therefore have more opportunity to spread their capital. The downside to such a strategy is that it could entail a lot more trades and in turn more work. I set out to overcome the amount of trades while increasing the diversification. The end result is stacking up so far.” The final name had not been decided at this time, but the blueprints were starting to take place.

Thereafter, there was a post on the 20th of June entitled “Revised – Growth Portfolio – 10 Share Portfolio.” This was an interesting blog post as it acknowledged the significant amount of stress testing that had taken place and went on to thank those of you who had contributed to stress testing, per the blog post: “Thanks to everyone who gave me their feedback on the first cut of the growth portfolio – 10 share portfolio. One common point of interest was how a growth portfolio stacked up over the GFC.

I went back to BackTester and ran the tests from 2007 through to present. After many tests, I am pleased to present the revised growth portfolio that holds up through the GFC…” (You can read more on this by CLICKING HERE.)

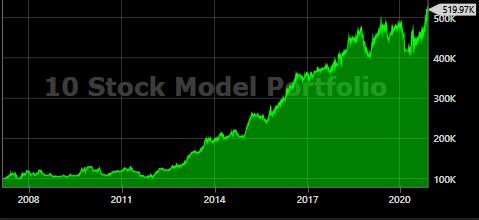

So where do I find the 10 Stock Model Portfolio in VectorVest right now? If you head over to the Viewers tab and then click on Trading System Viewer, you will see that the 10 Stock Model Portfolio has an Annualised Rate of Returns (ARR) of 30% currently. On average, it returns 30% per year. This does not mean every year. If you click on the Portfolio tab and then click on VectorVest Portfolios, select the 10 Stock Model Portfolio, you can view the graph and the current holdings. The 10 Stock Model Portfolio graph goes back since 2007 and held up in the GFC, but did not really get going until 2012. Since then, the portfolio has powered on. Not every year was a stellar year, but on average the portfolio moved in the right direction year in and year out since 2012.

Where am I getting at with this portfolio? Having the courage to stick to your trading plan! If you have BackTested your required portfolio, and you are happy with the overall performance and satisfied with your rule sets in place then it is time to stick to your trading plan. For the majority of 2020, the 10 Stock Model Portfolio was under water. It was slow to get out of the blocks, but eventually the portfolio got going as we would have expected on average based on the extensive BackTesting. Therein lies the lesson, have the courage to stick to your trading plans provided you have done the work. As of 25 November, the 10 Stock Model Portfolio has roared into life, having returned over 10% for the last 3 months and up over 8% for November alone. Was this luck? Or was this skill? The skill of VectorVest to give you the tools to design and test your portfolios…your skill set to use VectorVest and stick to your trading plan. It is the latter; it is skill not luck.

I am not saying that the 10 Stock Model Portfolio is the portfolio to follow, but it is a great example in play on what is possible where you apply VectorVest to refine your trading plan. I have seen this time and time again…where I have done my work, tested my trading plan and put in a few extra hard yards into perfecting my trading plans, the better my returns! How does your trading plan stack up…are you happy with your trading plan? If not, you know what needs to be done. You have the tools and all the support right here at VectorVest to make things happen!

Please CLICK HERE to see a bit more on the 10 Stock Model Portfolio.

DISCLAIMER: THE ABOVE ARTICLE DOES NOT CONSTITUTE FINANCIAL ADVICE. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU SHOULD CONSULT WITH YOUR LEGAL, TAX, FINANCIAL, AND OTHER ADVISERS PRIOR TO MAKING ANY INVESTMENT

Leave A Comment