Australia has the highest Dividend Yields in the world! That is according to Morningstar. Add in Franking Credits for Australia tax residents and you see why dividend paying ASX listed stocks have the highest dividend yields in the world.

What are Franking Credits? Companies pay out dividends from post-tax profits. To avoid double taxation, investors who receive dividends where company tax has been paid can claim a tax credit for the portion of company tax paid on the dividends in the form of Franking Credits.

Let’s look at an example: assume company XYZ pays you $1 in dividends and is trading at $25 a share. The Dividend Yield (DY) is an impressive 4%. Now assume the company has paid 30% tax on the dividend distributed (fully franked). The calculation for the gross dividend payout on fully franked dividends in this example is as follows: $1 / (1 – 0.3) = $1.4286. The investor receives a grossed dividend of $1.4286, where $1 is the dividend and $0.4286 is the Franking Credit. The grossed up DY (the dividend plus the franking credit) now becomes $1.4286. The fully grossed DY becomes $1.4286 / $25 = 5.7144% which is even more impressive than the 4% DY prior to Franking Credits!

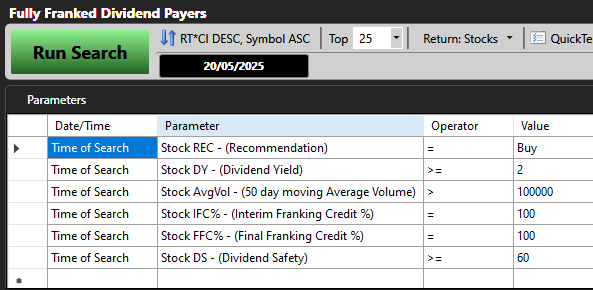

Are you taking advantage of the best dividends in the world? If not, we have a powerful UniSearch that will find you the best fully franked dividend paying stocks each day. To access the Fully Franked Dividend Payers search, click on the UniSearch tab. From there, open the Yellow Brick Road group (last UniSearch folder) and then click on the search: Fully Franked Dividend Payers.

The search finds top dividend paying and technical companies where the DY is 2% or higher, with full Interim Franking Credits (IFC) and Final Franking Credits (FFC) along with plenty of liquidity. The Dividend Safety (DS) for each stock returned must be 60 or higher out of a maximum score of 99. Over the years, we have found a DS score of 50 or higher for Australian stocks has proven a very reliable indicator for a company meeting or exceeding its dividend payments.

Running the search as of 20 May 2025, 16 stocks are returned. Many stocks stand out and the dividends are very impressive, let alone the Franking Credits.

Below is one such example in the returned results on 20 May 2025:

The DY is per the blue area on the graph and the Dividend Paid is in the green area line. DY is 2.62% as of 20 May 2025. Grossing this dividend to take account of Full Franking Credits is as follows: 2.62% / (1-0.3) = 3.74%.

Residents of Australia:

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment