Visa (V) reported 4th quarter earnings today that initially sent shares 2% lower. They have since rebounded and now sit about 1.5% higher than yesterday’s closing price.

This was a strange reaction to what was a fairly positive news cycle for the credit card company after beating earnings and raising dividends.

The credit card company posted earnings per share of $2.33 which beat out the consensus of $2.14 Wall Street had in place. The company also beat the analyst consensus for revenue with a figure of $8.6 billion, which was up 10.4% year over year.

It appears that much of this can be attributed to a burgeon in travel, as cross-border spending spiked 16% for the quarter. In fact, domestic travel has recently surpassed pre-pandemic levels. The TSA screened as many as 2.5 million travelers daily through all US airports.

However, CEO Chris Suh also attributes the uptick in payments to rising fuel prices. He said that the ticket size growth was led by higher costs of gas, as there wasn’t much change across other segments – everything else remained fairly stable.

Visa also sweetened the pot even further by announcing the company would raise its quarterly dividend to 52 cents per share – up 16%. The company also intends to buy back $25 billion in stock over the coming years.

V has been steadily climbing over the past year, up 24% in the timeframe. That being said, the stock has remained fairly stagnant over the past few months. But the hope is that today’s news will spark a trend in the right direction.

So, should you buy this stock and ride the anticipated momentum that is to follow?

Not so fast. We’ve taken a look at V through the VectorVest stock forecasting software and have uncovered a reason to hold off on buying for the time being. Here’s what you need to know…

Despite Very Good Upside Potential and Excellent Safety, the Timing For V is Just Fair

VectorVest tells you what to buy, when to buy it, and when to sell it with unparalleled precision - helping you win more trades with less work. It’s based on a proprietary stock rating system that gives you all the insights you need in 3 simple ratings.

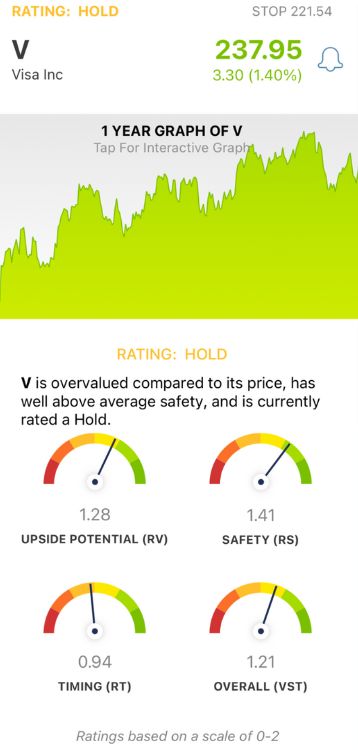

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average. Based on the overall VST rating, though, you’re given a clear buy, sell, or hold recommendation. As for V, here’s what you should know:

- Very Good Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out) and AAA corporate bond rates & risk. It offers much more valuable insights than a simple comparison of price to value alone. V currently has a very good RV rating of 1.28.

- Excellent Safety: The RS rating speaks to the risk associated with a stock. It’s computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, and other pertinent factors. V has an excellent RS rating of 1.41.

- Fair Timing: The one thing holding this stock back from a “buy” recommendation is the below-average RT rating of 0.94 - which is still deemed fair. The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. That being said, V will need to form a meaningful positive price trend and earn a better RT rating before it becomes a “buy”.

All this contributed to a good VST rating of 1.21 - but the stock is still deemed a HOLD at this time. You’ll want to stay up to date on the RT rating for V and watch for it to move above the average and into a more positive range.

You can transform the way you trade by leveraging the VectorVest system. Get a free stock analysis today and see how much simpler and stress-free investing can be!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. V delivered impressive 4th quarter earnings and raised its quarterly dividend. The stock has very good upside potential and excellent safety - but fair timing is holding the stock back from a BUY recommendation right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment