United Parcel Service, or UPS (UPS), will officially replace FedEx as the United States Postal Service’s primary air cargo provider. This comes after FedEx and USPS failed to agree on new contract terms, which were set to expire later this year on September 29th.

FedEx wanted to negotiate a better deal, and ultimately, ended up walking away. The two companies were engaged in a partnership for more than 22 years, as the USPS was FedEx’s largest customer for air-based express shipments.

But, FedEx has been struggling to dial in expenses and boost profitability amidst skyrocketing costs throughout its business – from gasoline to jet fuel and wage inflation. Some analysts believe that cutting back on its air capacity after splitting ways with USPS will actually be a good thing in the long run.

While the specific financial details were not disclosed, UPS did admit that the award for the contract was “significant”. There will be a transition period before the partnership ramps into full swing.

The initial news of this deal sent UPS shares nearly 2% higher, but they’ve since fallen to a 1.5% drop on the day. The stock is now down nearly 7% in the past week and 24% in the last year.

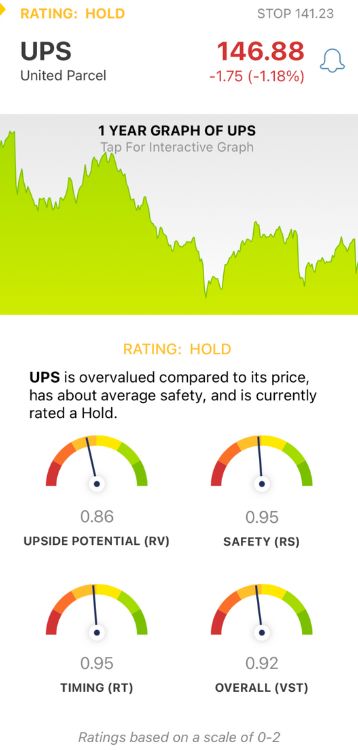

Many analysts are cutting their price targets on the stock, but is this new deal enough to earn UPS a buy? We’ve taken a look at the current situation in the VectorVest stock analysis software. There are three things current or prospective investors need to know…

UPS Has Fair Upside Potential, Safety, and Timing, But It's Not Quite Time to Buy

VectorVest saves you time and stress while empowering you to win more trades with less work. It’s all based on a proprietary stock rating system that delivers actionable insights in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Better yet, you’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for UPS, here’s what we found:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. As for UPS, the RV rating of 0.86 is a ways below the average but deemed fair nonetheless. That being said, the stock is overvalued with a current value of $113 compared to its current price of $146.

- Fair Safety: The RS rating is a risk indicator that’s calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.95 is fair for UPS.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.95 is fair for UPS.

UPS has an overall VST rating of 0.92, which is fair - but not enough to earn the stock a buy recommendation. It’s currently rated a hold in the VectorVest system.

That being said, you’ll want to stay up to date on this opportunity as it evolves. You can get a free stock analysis at VectorVest today to learn more and change your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. UPS was awarded the primary air cargo provider for USPS, replacing FedEx after a 22 year run. The stock hasn’t benefited from the news yet, down a little more than 1% today. That being said, it still has fair upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment