Early this morning Target (TGT) reported second-quarter earnings that beat expectations while revenue fell just short of analyst estimates.

But, the key takeaway from the call was that the company was reevaluating its full-year guidance, walking back its previous forecast. In fact, the company is expecting sales to decline by mid-single digits for the full fiscal year.

Inflation has slowed down and many experts are in agreeance a recession isn’t looming as large as it did earlier this year. Still, Target is finding it a challenge to convince its thriftier shoppers to buy anything more than the bare necessities.

Customers have been buying less clothing, home decor, and nonessential items. And even though the retailer offers groceries and essential household items, the premium for these segments has scared shoppers toward more affordable retailers.

CEO Brian Cornell admitted that the negative reaction to Target’s Pride collection had a tangible impact on sales for the quarter, too. We wrote about this back in late May as Target shares fell amidst the backlash of the company’s LGBTQ+ line.

As a result of all this, the company reported earnings per share of $1.80 compared to the $1.39 expected. Revenue was $24.77 billion, just shy of the $25.16 billion expected. For the rest of the year, Target’s new earnings guidance is $7-$8/share, down from the previously forecasted $7.75-$8.75/share.

The company remains optimistic that things will turn around as steps have been taken to make prices more affordable, and back-to-school season is just on the horizon. That being said, TGT stock has been battered over the last year – down 27% since this time last year.

Whether you’re a current investor in TGT or are considering trading it, we’ve got 3 things you need to see to help you determine what your next move should be. Here’s what we’ve discovered through the VectorVest stock analysis software.

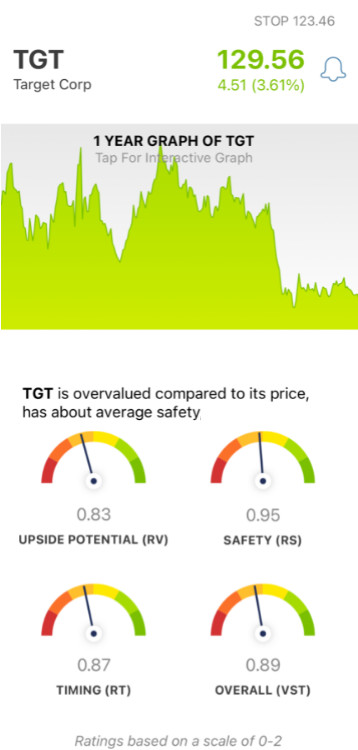

TGT Has Poor Upside Potential but Fair Safety and Timing

The VectorVest system simplifies your trading strategy by giving you all the insights you need in 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 for quick and easy interpretation, as high ratings indicate overperformance in a given rating and vice versa. But, based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation - at any given time. As for TGT, here’s what we’ve found:

- Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (3 years out) and AAA corporate bond rates & risk. As for TGT, the RV rating of 0.83 is considered poor. On that note, the stock is also overvalued, with a current value of just $99.39/share.

- Fair Safety: The RS rating is an indicator of risk and comes from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for TGT, it’s a fairly safe stock with an RS rating of 0.95 - just below the average.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price trend. It’s calculated day over day, week over week, quarter over quarter, and year over year. As for TGT, the RT rating of 0.87 is a ways below the average but deemed fair nonetheless.

The overall VST rating of 0.89 is fair for TGT, but where does that leave you? Is it worth buying more shares of this stock, or is this your sign to cut losses? Should you hold on a bit longer to see what awaits in the days, weeks, and months ahead?

A clear answer awaits you at VectorVest’s a free stock analysis. Don’t let emotion or guesswork influence your trading strategy - feel more confident with VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. TGT has been battered this year by declining sales and the Pride Month backlash. The latest earnings were much of the same. The stock has poor upside potential, and its safety and timing are just fair right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment