Monday morning saw the negative price trend for SNAP stock continue to strengthen, as shares fell an additional 3.5% by 11 AM EST. This came after Jeffries analyst James Heany joined Yahoo Finance to discuss the future for Snapchat – where he issued a grave warning to investors. We are nowhere near the bottom.

While many on Wall Street are expecting 2023 to be a year of prosperity for Snapchat – where the company can see as much as 9% growth – Heaney and the rest of the Jeffries team disagree. He went on the record today stating that figure could be 2% in a best-case scenario – worse if the economy continues to trend towards a recession.

It’s true that daily users are continuing to grow for Snapchat. But the next few years could be unforgiving for the company. In fact, Heaney doesn’t expect to see profits from Snapchat until 2027 – again, in best-case scenarios. This forecast could be pushed out as far as 2030 in some models depending on how bad the economy gets over the next few years.

During the interview, a concerning comparison was made between Snapchat today and Google during the last recession. Google saw revenue growth drop from 40% to 3% in a matter of quarters. Today, Snapchat has seen revenue growth fall from 50% to potentially 0%. This is of course due to recession concerns affecting ad revenue – but also limitations due to Apple’s privacy changes.

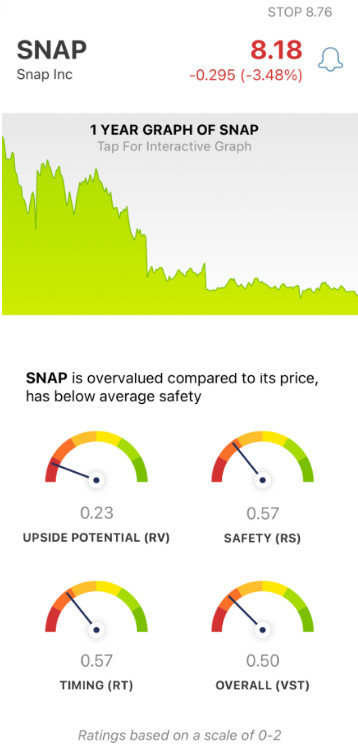

When we last checked in on SNAP stock in the middle of October the company posted record-low share prices of around $10. Today, the stock sits even lower at $8/share – and analysts believe we’re not even close to the bottom. Moreover, we’ve taken a deep look at the stock through the VectorVest stock forecasting system and identified 3 major red flags.

So – if you’re wondering if now is finally the time to cut losses on your stock – or if you should keep holding on in hopes of a rebound – keep reading…

SNAP Has Very Poor Upside Potential With Poor Safety & Timing

The VectorVest system transforms the way you approach stock analysis – granting you effortless insights into what’s really going on with a stock. With just 3 simple ratings you’re given all the information you need to make sound investment decisions. These ratings are relative value (RV), relative safety (RS), and relative timing (RT).

The ratings are easy to interpret as they sit on a scale of 0.00-2.00 – with 1.00 being the average. Just pick stocks with ratings trending above the average to win more trades! Or, better yet, just follow the definitive buy, sell, or hold recommendation that VectorVest offers for any given stock, at any given time, based on these ratings. As for SNAP, here are the current problems:

- Very Poor Upside Potential: Taking a look at the long-term price appreciation potential 3-years out for SNAP, VectorVest doesn’t see much to be optimistic about either. As a result, SNAP has earned a very poor RV rating of 0.23. Moreover, the stock is overvalued at its current price – with a current value of just $1.56/share.

- Poor Safety: An indicator of risk, RS analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. All this considered, the RS rating of 0.57 is poor.

- Poor Timing: Finally, the price trend for SNAP is very poor – and the RT rating of 0.57 reflects that. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

As a result of these three ratings, VectorVest has provided an overall VST rating of 0.50 – which is very poor. Does that mean it’s time to sell? Get a clear recommendation through our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SNAP, it is overvalued with very poor upside potential and poor safety/timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment