Shopify has made moves this morning after reporting Q3 earnings that were better than anticipated. So far, the cloud-based eCommerce platform is up 18% as of 1:30 pm EST. And while this is definitely a step in the right direction, investors and analysts alike are still not sure the time is quite right for Shopify.

Nevertheless, after 6 quarters of continuously slowed growth, Shopify has reported an increase in revenue. While the company did lose 2 cents/share, revenue rose up to $1.4 billion – a 22% increase . Meanwhile, analysts were anticipating just $1.34 billion with a loss of 7 cents/share. In the previous year period, Shopify reported a loss of 8 cents per share and revenue of just $1.12 billion.

There are a few reasons SHOP outperformed expectations. They acquired the logistics firm Deliverr®, for one. They also reaped the benefits of a strong US dollar, which makes up much of their revenue. Meanwhile, their expenses are primarily driven by the Canadian dollar. Shopify also drove higher revenue from their subscriptions segment – up 12% from the previous year’s period.

It’s important to note that while this third quarter was a step in the right direction, Shopify finds itself in quite a hole – and it will take some time to climb out of it. The company boomed during the early stages of the pandemic and felt the effects of a return to normalcy over the past year. Since November 2021, the e-commerce platform has seen its stock slide down over 75%. Right now, SHOP stock sits at a share price of $33.40/share – a stark comparison to where it was just over a year ago at $169/share.

Even analysts, like Samad Samana of Jeffries, claim that investors should exercise caution as Shopify still has quite a bit of work to do to get back on the right track. However, this third quarter could be the catalyst for a continued trend in the positive direction. The question now is, can Shopify put up back-to-back quarters of positive growth?

That remains to be seen. In the meantime, investors like yourself want to know whether this could be a good opportunity to buy SHOP stock at a great value. For this information, we can look to VectorVest’s stock forecasting software. The system simplifies trading and offers up a clear buy, sell, or hold recommendation for any given stock, at any given time. Let’s see what’s happening with SHOP through the VectorVest lens:

SHOP has Very Poor Upside Potential, but a Positive Price Trend is Forming

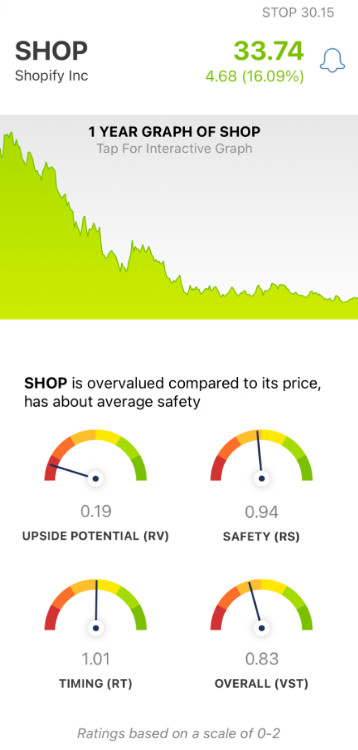

The VectorVest system offers effortless insights into how you should navigate the stock market. It does this by summarizing everything you need to know about a stock into three easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 for easy interpretation – the higher the rating, the better.

Together, these make up the overall VST rating a stock is given, and dictate whether VectorVest rates the stock a buy, sell, or hold. As for Shopify, here’s the current situation:

- Very Poor Upside Potential: the RV rating looks at a stock’s long term price appreciation potential, forecasted up to three years out. The current RV rating of 0.19 is very poor. This is coupled with the fact that SHOP is overvalued at the current share price of around $33. VectorVest calculates the current value to be just $5.98.

- Fair Safety: the RS rating for SHOP is fair at 0.94 – just below the average. This rating takes into account a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: the RT rating of VectorVest is just fair at 1.01 – but, it does suggest a positive price trend is forming. This rating looks at the direction, dynamics, and magnitude of a stock’s price trend day over day, week over week, quarter over quarter, and year over year. It remains to be seen whether this RT rating will continue gravitating in the right direction.

Taking all these ratings into account, VectorVest has provided an overall VST rating of 0.83 – which is poor. But, what does that mean for investors? Does that mean it’s time to sell any remaining shares you have? Is this a good low point to make an entry? Or, should you continue holding to see if this price trend continues or strengthens? Get a clear answer on your next move with a free stock analysis.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SHOP, it is overvalued with poor upside potential but it has fair safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment