Salesforce (CRM) delivered its 4th quarter earnings yesterday after trading hours, and the stock is up 12% so far in Thursday’s session. The company’s cost-cutting efforts are starting to pay off in a major way.

Revenue itself soared 14% up to $8.38 billion, but what really has investors and analysts excited is profitability. The company saw a 100% growth in EPS – up to $1.68/share compared to $0.84/share this time last year. Analysts were expecting just $1.37/share.

The company has been working to cut costs wherever possible, which is something we wrote about back in the first week of the new year amidst Salesforce layoffs. Beyond trimming the company headcount, Salesforce has taken steps to improve sales, marketing, and general/administrative efficiency.

Salesforce expects this trend to continue in the year ahead, as executives issued an upbeat outlook for fiscal 2024 with operating margins as high as 27%. But they aren’t stopping there. The company expects margins in excess of 30% as soon as April 2025.

In the near term, Salesforce is expecting to exceed analyst estimates for the current quarter. The company expects revenue of $8.17 billion compared to the consensus of $8.04 billion.

On top of improved profitability and overall growth, the company has doubled down on the stock buyback program we discussed back in August of 2022. While Salesforce initially approved a $10 billion buyback, that figure is now $20 billion.

As an investor, you’re wondering where Salesforce fits into your investment strategy after today’s news. Is it time to buy CRM stock? You don’t have to play the guessing game or let emotion influence your decision-making – we’re going to provide you with a clear answer on your next move. Here are 3 key takeaways gathered through the VectorVest stock analyzer software.

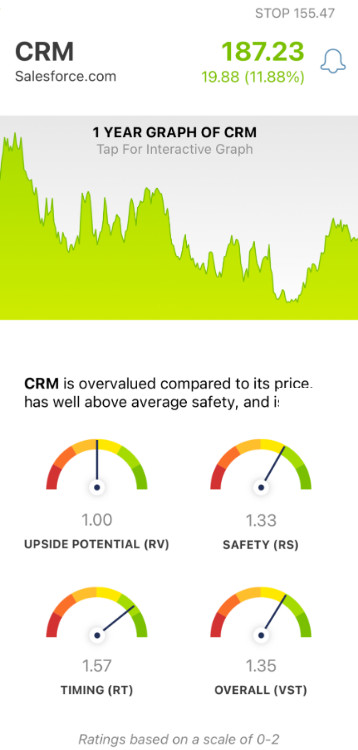

With Fair Upside Potential, Very Good Safety, and Excellent Timing, is Now the Time to Buy CRM?

The VectorVest system saves you time and eliminates costly errors from your strategy by giving you all the insights you need in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on a scale of 0.00-2.00 with 1.00 being the average. And based on these ratings, VectorVest is able to give you a clear buy, sell, or hold recommendation - helping you win more trades with less work. As for CRM, here’s the current situation:

- Fair Upside Potential: The RV rating assesses a stock’s long-term price appreciation potential (three years out) compared to AAA corporate bond rates and risk. And right now, the RV rating of 1.00 is fair - right at the average.

- Ver Good Safety: An indicator of risk, the RS rating analyzes a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for CRM, the RS rating of 1.33 is very good.

- Excellent Timing: In looking at the price trend for CRM, it’s clear that the stock has momentum in its sails. The stock is up about 24% in the first 3 months of the year - and 12% today alone. And this trend is confirmed by the excellent RT rating of 1.57. This is calculated from a deep analysis of the direction, dynamics, and magnitude of the stock’s price movement.

The overall VST rating for CRM is very good at 1.35. Last time we wrote about CRM, the VST rating was a mere 1.06 - which was just fair. Things have certainly changed for this stock since the start of the year. So - should you buy shares today? Get a clear answer on your next move with a free stock analysis today - you don’t want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, the upside potential for CRM is just fair - but the stock has very good safety and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment