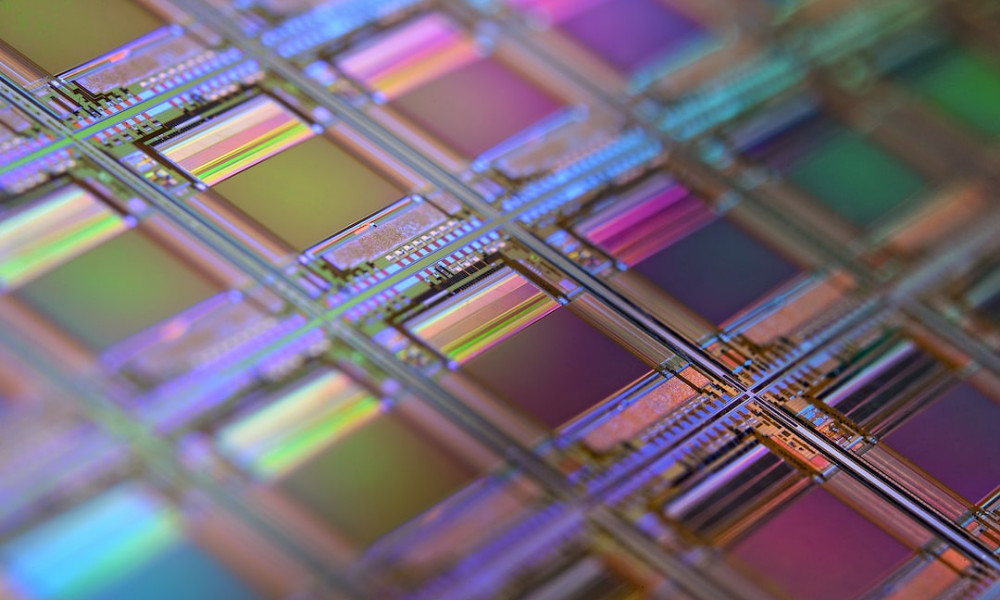

Automakers have struggled for a few years now to meet demand as semiconductor chip shortages have ravaged the industry. This has been a result of the COVID-19 pandemic shutting down factories and putting production on pause.

But for General Motors, this issue looks to be one of the past. Yesterday, the automaker announced the signing of a long-term agreement with GlobalFoundries, making the semiconductor manufacturer the sole producer of chips for GM.

This deal is being referred to as a first in the industry, as the production of GM’s semiconductor chips will now be 100% US-based. GlobalFoundries will roll out dedicated production processes in upstate New York to meet the demand.

But more than that, we’ve rarely seen automakers partner directly with chip producers. It’s expected that competing automakers will use this framework themselves as the demand for chips is only going to climb in the next few years. In fact, GM expects their needs to double in that time span.

While both companies in this deal declined to disclose details such as cost or terms, it’s clear that both parties are winners here. GlobalFoundries will likely have no issues with demand anytime soon and will enjoy a consistent stream of revenue from the deal. On the other hand, GM has found a resilient, reliable supplier for their chips – and looks good in the eyes of the Biden administration, which seeks to bring all semiconductor supply here to the states.

Now, in looking at both companies from a stock analysis standpoint, are either of these stocks worth adding to your portfolio? Perhaps both? We’ll take a look at each company through the VectorVest stock forecasting software below.

Is GM or GFS Worth Adding to Your Portfolio? Here’s What You Need to Know…

The VectorVest system simplifies trading by telling you everything you need to know in 3 simple ratings:

- Relative value (RV): A comparison of a stock’s long-term price appreciation potential compared to AAA corporate bond rates and risk.

- Relative safety (RS): An indicator of risk that assesses a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Relative timing (RT): An indicator of a stock’s price trend - which analyzes the direction, dynamics, and magnitude of that trend.

Interpreting these ratings is easy - as they sit on a simple scale of 0.00-2.00, with 1.00 being the average. But to really eliminate guesswork or emotion from your strategy, VectorVest provides a clear buy, sell, or hold recommendation based on these three ratings. It doesn’t get any easier than this - and you’ll enjoy a higher rate of success leveraging this system as part of your strategy.

Let’s first take a look at GM:

- Good RV rating of 1.13

- Poor RS rating of 0.82

- Very good RT rating of 1.28

- Overall VST rating of 1.10 - which is good

As for GFS:

- Good RV rating of 1.17

- Poor RS rating of 0.77

- Very good RT rating of 1.37

- Overall VST rating of 1.14 - which is good

Now, are either of these stocks rated a buy? Both have a good overall VST rating - and appear to have a solid price trend as a result of this partnership. But if you’re considering adding either stock to your portfolio, you’ll want to get a free stock analysis from VectorVest first. Don’t miss out on this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, both GM and GFS have good upside potential, poor safety, and very good timing - but to find out if either one of these belongs in your portfolio, you’ll want to see the full picture through the VectorVest system.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment