One of this morning’s big movers during premarket hours was Splunk. The company operates in the development of cloud software solutions. The stock price was up over 8% before the market opened, and while it took a bit of a detour along the way, it’s still up almost 6% as of 11 am EST.

While Splunk (SPLK) stock is down over 54% in the past year, we’re seeing more and more news of analysts and investors looking at the company positively.

Just last week CFRA Research analyst John Freeman upgraded his recommendation for Splunk to a buy. The reason is that – according to Freeman – the stock still holds unique advantages in data processing and analysis of real-time streaming data. Not only would this advantage be difficult for Splunk’s competitors to replicate – but Freeman also believes this will expand at historical rates with more new use cases to drive demand.

And while Freeman is the first in recent news to spread this sentiment, he’s not alone – there are 39 other analysts who rate it a buy, echoing his sentiment. But perhaps more importantly, one hedge fund is putting its money where its mouth is – and has initiated a 5% stake in Splunk. Starboard Value LP is a hedge fund that looks to invest in companies they believe could be poised for takeover or sale – or that could benefit from operational improvements.

There is a suite of reasons investors and analysts alike have started flocking to Splunk – they believe it’s undervalued at its current price. Compared to the business’s actual performance, the current price of around $74 is a bargain – at least, that’s the argument that the analysts and investment firms in question are making. In fact, some of these parties have set a price target as high as $129.80.

Now, is there any real reason to believe that this software cloud provider could experience a 60%+ jump any time soon? We’re not sold just yet. As an investor, you want a clear answer on what your next move should be with Splunk. Should you buy now amidst this hype in hopes that it serves as a catalyst for long-term price movement? Or, should you wait a bit longer to see real, tangible reasons to invest in Splunk other than analyst/investor sentiment?

The VectorVest stock forecasting software can help you make effortless, emotionless decisions with a clear buy, sell, or hold recommendation for any given stock, at any given time. Here’s what you need to know about Splunk stock…

Poor Upside Potential & Timing Make it Hard to Justify an Investment in Splunk

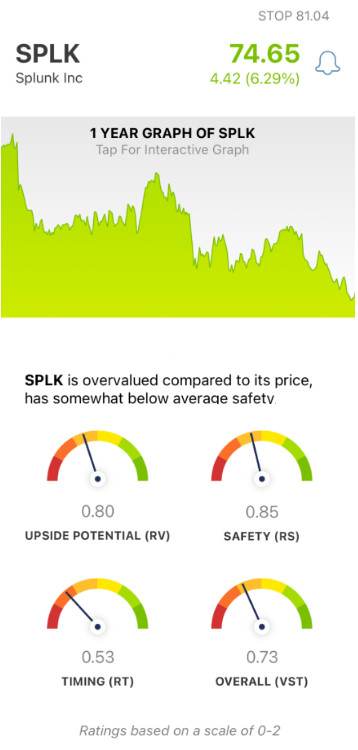

The VectorVest system simplifies stock analyses by boiling down everything you need to know about an opportunity into three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). These are put on a scale of 0.00-2.00 – with 1.00 being the average. Anything higher than the average indicates overperformance in a given rating and vice versa.

And based on the average of these three ratings, the system provides you with an overall VST rating along with a buy, sell, or hold recommendation. As for SPLK, here’s the current situation:

- Poor Upside Potential: While analysts believe SPLK is undervalued at its current share price, the VectorVest system feels the opposite. It deems the stock way overvalued at the current price of $74.65, with a current value of $11.27. Meanwhile, the RV rating of 0.80 is poor – indicating poor long-term price appreciation potential.

- Fair Safety: An indicator of risk, the relative safety rating takes a look at a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for SPLK, the RS rating of 0.85 is below the average – but is fair nonetheless.

- Poor Timing: Despite the temporary positive price trend we see forming today, the overall price trend for SPLK is still poor – as the RT rating looks at trends not just day over day, but week over week, quarter over quarter, and year over year. It factors in the direction, dynamic, and magnitude of a stock’s price movement. And right now, the timing still isn’t quite right for SPLK – as the RT rating of 0.53 is poor.

All things considered, the overall VST rating for SPLK is poor at 0.73. So, should you stay away from SPLK for now? If you’re currently invested in the company, is this temporary bump a good opportunity to sell and recoup some of your losses? To get a clear answer on your next move with this stock, you can analyze stock free here – you’re not going to want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SPLK, it is overvalued with poor upside potential, fair safety, and poor timing – even with the temporary positive price trend we’re seeing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment