Bitcoin ETFs are Running Hot!

On 11 January 2024, 11 Bitcoin ETFs were approved by the SEC for the US market. The ticker codes for the approved Bitcoin ETFs are: ARKB, BITB, IBIT, EZBC, FBTC, GBTC, DEFI, BTCO, HODL, BRRR and BTCW. With the approval, Bitcoin went from a speculative asset that retail investors typically dabbled in and transitioned to an asset class accessible to both retail and institutional investors who were previously reluctant to invest in Bitcoin via a crypto exchange.

You can analyse all these ETFs in VectorVest US by clicking on the US flag, then enter your username and password exactly as you do when logging into Australia.

The new Bitcoin ETFs provide the safety and regulation of the New York Stock Exchange and the Nasdaq. No need to invest directly into Bitcoin via one of the crypto exchanges, many of which have been compromised and hacked over the years.

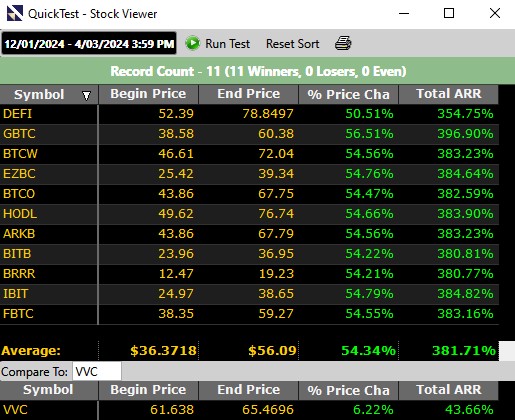

VectorVest listed the 11 new ETFs on 12 of January 2024. These ETFs have surged over 50% (as of 4 March 2024) on the back of the Bitcoin price.

As of 5 March 2024, the demand for Bitcoin is higher than the daily supply each day. At present, 900 new Bitcoins are mined a day. BlackRock’s ETF (IBIT) has acquired more than $10 billion USD worth of Bitcoin over the last 2 months alone. Fidelity’s ETF (FBTC) has acquired over $6.5 billion USD worth since January 2024 through to the end of February 2024.

To put this into context, the first gold ETF (GLD) listed in 2004 in the US took 2 years to break the $10 billion USD mark. In contrast, BlackRock’s IBIT has broken the $10 billion USD investment mark in 39 trading days. It is of interest to note that Bitcoin ETFs as of the end of February 2024 have just under half the value invested in gold ETFs.

In our weekly Essay of 8 December 2023 titled “Bitcoin Surging,” we alerted our subscribers to the impending launch of Bitcoin ETFs, highlighting the upside and risks associated with this volatile asset class. Those who got into these Bitcoin ETFs early would have made some significant profits. Once again, we emphasise that this is not for the risk averse. It is anyone’s guess as to how long this rally will last, but as a VectorVest subscriber you do have the tools for ETF selection and risk management.

On a final note: we are running an ETF Challenge for all our subscribers. This is a superb opportunity to fine tune an ETF strategy for the US Market. US ETFs are becoming very popular in Australia. Please CLICK HERE for all the details and rules of the contest. The contest will run from the market’s Open on Monday, April 1, 2024, and end at the market’s Close on Friday, June 28, 2024.

PS – As of 5 March 2024, 6pm AEST, Bitcoin is trading at over $100,400 AUD per Bitcoin. In our weekly Essay of 8 December 2023, the price of Bitcoin was at $66,855 AUD.

Residents of Australia:

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment