PORTFOLIO REVIEW 2020!.

Written by: Robert and Russell Markham

Happy New Year! What a year it was for the VectorVest Portfolios that we track each day. For the period 1 January 2020 to 31 December 2020, I am pleased to note that all the Portfolios except 1 had positive returns!

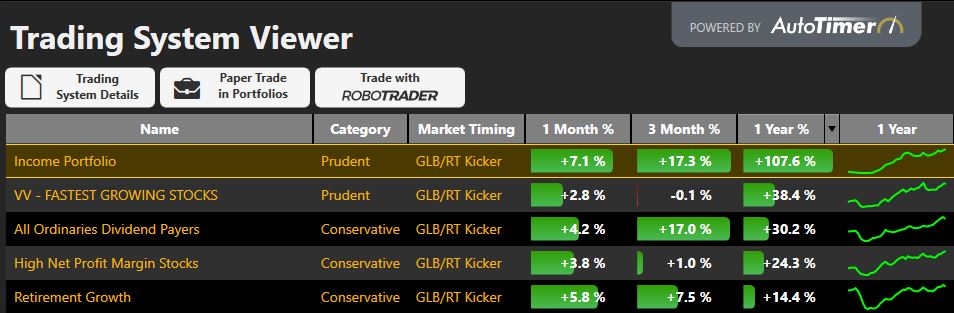

If you are new to VectorVest, and you are not aware of the Portfolios we track, you can check them out by clicking on the Viewers tab and then clicking on Trading System Viewer (per the left of your screen). As of 31 December, if I click on the YTD button, I can see that the year closed out with some phenomenal returns. The Income Portfolio cracked triple digits! VV-FASTEST GROWING STOCKS at a sensational 39% followed by the All-Ordinaries Dividend Payers at 30% and the High Net Profit Margin Stocks portfolio coming it at 26%.

Where there is a portfolio that notes Course (per the Add-Ons) column, one will need to complete a course to get access to the Portfolio. For today, I just want to concentrate on the top 2 Portfolios, that being the Income Portfolio and the VV-FASTEST GROWING STOCKS Portfolio and look at the best performing trades in those 2 portfolios. What drove these top 2 performers this year?

Click on the Income Portfolio and once selected per the top part of your screen, click on Trading System Details. This sets out all the key performance statistics. As of 31 December 2020, the Income Portfolio notes a Year-to-Date return of 100.55%! The last 3 months notes 16.53% and the last 6 months notes 39%. If you scroll down a bit, you will see the current holdings. MIN.AX and NWH.AX are 2 such holdings per 31 December, both up over 30%. In fact, all the current holdings as of 31 December are up! Now click on the Trading System Rules (blue button at the top right of the screen) and this will break out the exact rules set to the Portfolio. Try getting that type of detail from your fund manager! From here you can see the exact rule sets. Close out of this view and return to the Trading System Viewer.

Repeat the above process for the VV-FASTEST GROWING STOCKS Portfolio. Notice the returns have been over 9% for the last month! Some of the current holdings include XRO.AX (up over 85%), MIN.AX (up over 30%) and FMG.AX (up over 25%). As of 31 December, just one holding is currently down (AEG.AX) and the rest are up.

If you want to drill down a bit deeper to find out all of the trades, for the Income Portfolio per the Portfolios tab (which I will show you how to do in the video). For VV-FASTEST GROWING STOCKS – we are going to setup a BackTest to develop the full set of trades to show you.

I have done this per the video below…here is a key summary of the findings:

* KGN.AX, MIN.AX, FMG.AX and IRI.AX were the best performers in the portfolio – returning over 90% on average on these 4 trades (thanks in part to KGN.AX that lifted the average).

* TPW.AX, CMM.AX, FMG.AX and SLR.AX were some of the biggest performers in the VV-FASTEST GROWING STOCKS Portfolio – returning over 86% on average on these 4 stocks (thanks in part to TPW.AX that lifted the average)

* The worst performers for Income Portfolio were PPG.AX and PTL.AX

* The worst performers in the VV-FASTEST GROWING STOCKS Portfolio were WAF.AX and RBL.AX

* The overall gains far exceeded the losses in both portfolios. It is often only 2 or 3 stocks that can make all the difference between average returns to exception returns

By having a trading plan and sticking to a trading plan, you too can get yourself into a position to buy stocks like KGN.A and TPW.AX that had such a big impact on the above two given portfolios for 2020. Have you got your trading plans ready for 2021? If not, now might be that time.

Please CLICK HERE to see the video.

Leave A Comment