LITHIUM STOCKS.

Written by: Robert and Russell Markham

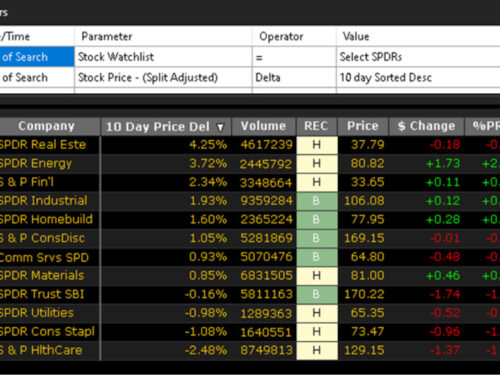

We’ve recently had a request to add in a new WatchList for Lithium stocks. We are pleased to announce that we have added this WatchList! You can access this WatchList via the Viewers tab, per the WatchList Viewer, and then selecting the Commodities group. Within the Commodities group is the new Lithium WatchList.

Why Lithium, what is so special about Lithium? In short – Batteries…electric cars! Lithium is a key ingredient in rechargeable batteries to store power. “…a single car lithium-ion battery pack (of a type known as NMC532) could contain around 8 kg of lithium, 35 kg of nickel, 20 kg of manganese and 14 kg of cobalt, according to figures from Argonne National Laboratory. Please click here to read more. Recall how we wrote about Nickel on the 30th of October 2020 in the VectorVest Views entitled “Is Nickel the New Gold” – if you missed that Essay, it is well worth a read. We will cover manganese and cobalt in future Essays too (as the electric revolution powers on).

Back to Lithium. To clarify, it is not just electric consumer vehicles that require a lot of lithium, but commercial electric vehicles too. Yes, there are commercial electric vehicles coming onto the market. Buses, trucks and trains…keep a lookout for them. In addition to electric transportation, the industry of energy storage is more important than ever. With more wind, solar and geothermal projects coming on stream, the energy created must be immediately used or it is lost forever – but battery technology changes that now. One need only look at the South Australian 100-Megawatt Tesla battery that powers rural South Australia.

This got us thinking – who are the biggest suppliers of lithium in the world? Australia leads the world with 55,000 tonnes mined in 2021, followed by Chile at 26,000 tonnes mined and China in at third place having mined 14,000 tonnes. From a world supply perspective, Western Australia is key. Western Australia supplies around 60% of all the world lithium from 5 mines. Australia is a world leader in lithium mining! Let’s look at the demand and supply side for lithium:

Demand Side of Lithium:

* Roughly 75% of all Lithium mined by 2025 will go to electric vehicles.

* Lithium is found in cell phones, laptops, tablets – all increasing in demand each year.

* More battery demand for electricity storage to decarbonise economies.

Supply Side of Lithium:

* The easier Lithium reserves have been mined; the more expensive (marginal) supply is now the next step to bringing supply to the market.

* Project financing and mine construction are required to keep up with new supply requirements.

* New technologies are being tested to mine Lithium – there is no shortage of Lithium. The key is to mine it at an acceptable price.

As such, there are several reputable forecasts out there forecasting shortages in Lithium over the years. One need only look at the recent spot prices to see that price is going higher as a result of demand not keeping up! Please click here to see one such graph.

Going through the WatchList we referred to at the start of this weekly Essay, out of the 66 Lithium stocks we have in our WatchList, 2 key companies jumped out:

The first one is Pilbara Minerals (PLS.AX). PLS.AX is the only Lithium company in our WatchList that has a consistent rising set of earnings along with rising Sales (as of 22 March 2022). Furthermore, the Earnings Growth rate for PLS.AX jumped out at a staggering 52%. Investigating PLS.AX further, PLS.AX owns the largest hard rock lithium operation in the world – that being the Pilgangoora Project. You can read up more on it per the PLS.AX website by clicking here.

The second stock that stood out: MIN.AX. The Wodgina mine run by MIN.AX is one of the largest hard rock lithium deposits in the world! Please click here to read more. MIN.AX has had a great set of rising earnings until a recent slump in 2021, but those earnings are trending higher again. We note that the Sales (Millions) which you can add onto your graph for MIN.AX are ticking up higher and higher too.

Do any other Lithium stocks jump out at you in the lithium WatchList? Did we miss any Lithium stocks? Please email us to let us know so we can add these in. We will continue to track our Lithium listed stocks in VectorVest in the weeks and months to follow!

This week we have put together a short video where we take a closer look at our two shortlisted Lithium Stocks. Please click here to see this week’s video!

If you have further questions about the information provided in the webcast, please give us a call. Our VectorVest Consultants are ready to help you.

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704).

Please refer to our Financial Services Guide at https://vectorvestau.wpengine.com/financial-services-guide/ which provides you with information about us and services we can provide. Any advice is general advice only and does not consider your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances.

Any advice is general advice only and does not consider your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances.

Past performance is not a guarantee of future results. Forecasts and BackTests used or discussed in this presentation are intended as a guide only and actual results may be affected by known or unknown risk and uncertainties and therefore may differ materially from results ultimately achieved.

Leave A Comment