KEEPING IT SIMPLE WITH VECTORVEST!

Written by: Robert and Russell Markham

Once you get to grips with VectorVest, you should not have to spend much more than a few minutes a day in the system. With the mobile app for both the Apple iPhone and Android, keeping on top of your portfolio is quick and easier than ever before.

For those of you who have done your BackTesting and converted your portfolios over to the Portfolios tab, following your portfolio is very easy. Simply click on Tools at the top right of your VectorVest screen and select Application Settings. Click on the Alerts tab in the Settings box and make sure you have a checkmark under Portfolio/Order. After, you simply follow the alerts as they take place. It can’t get much easier than that. You can get the alerts through your email after you’ve set up Alerts or on your device by simply installing the VectorVest App for either your Apple iPhone/tablet or your Android phone/tablet.

What about a really easy way to manage some cherry-picked stocks? Here is a great process you can consider:

Step 1: Check Market Timing

Step 2: Once Market Timing is in your favour, purchase stocks with smooth left to right price patterns along with consistent rising earnings

Step 3: Put the stocks identified into a WatchList

Step 4: Manage your stocks applying Dr. DiLiddo’s 4 Steps to Protecting Profits

Let me elaborate further on the steps:

Step 1: Go to the Market Timing Graph. The quickest way is to click on the Timing tab and then click on Market Timing. Per the Market Timing Graph, wait for your preferred market entry signal to take place. At the bottom of the graph, to the left of “Last Close” there is a dropdown menu where you can change the signals to overlay on the graph. I would suggest starting off with our most conservative Market Timing signal: Confirmed Calls. Wait for the Confirmed Up, C/Up, to take place. The last C/Up took place on 9 January 2019. I will run with 9 January in this example.

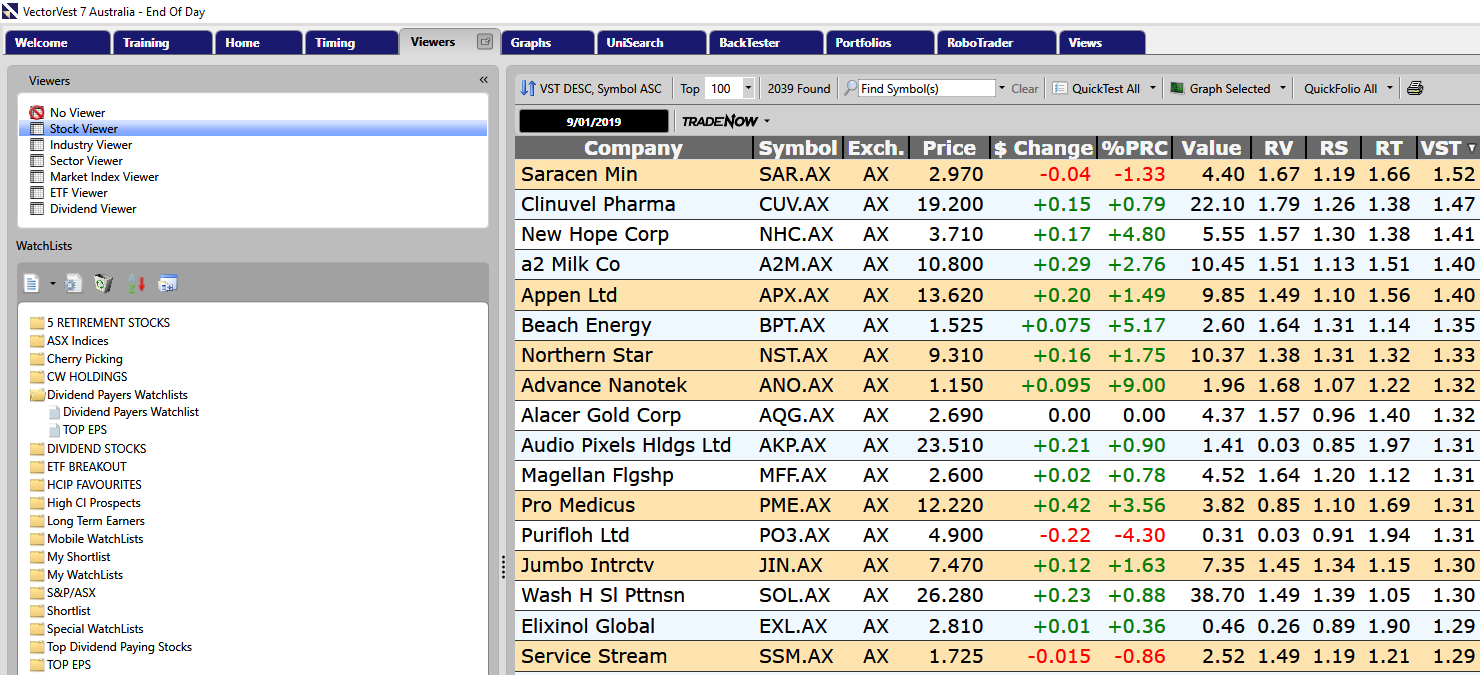

Step 2: Go to Stock Viewer by clicking on Viewers, then Stock Viewer and use the calendar to select 9 January. Ensure the list is sorted by VST in descending order (this is the default layout). Graph the top 20 stocks (you can select less or more if you wish depending on how many stocks you are after). Identify the stocks with the best left to right price patterns along with the best earnings profiles (EPS). You want both to be trending up as smooth as possible from left to right. For this exercise, ignore any data after 9 January since you would not have had that information! How far back should you graph the stocks? I pulled the graph back about 18 months, I wanted to see what was working leading up to 9 January.

For the exercise, the stocks that jumped out to me on 9 January: SAR.AX, ANO.AX, APX.AX, NST.AX, PME.AX, JIN.AX, SSM.AX. Would you have picked these stocks based on the historical graph up to 9 January 2019? What would your list have been?

(Click on the Image to enlarge)

Step 3: Put those shares into a WatchList. If you need any help on this step, check out the Welcome tab in VectorVest, the Build a WatchList Tutorial will help you get this done in minutes.

Step 4: Apply Dr. DiLiddo’s 4 Steps to Protecting Profits. Here are the 4 Steps:

Step 1: Look for your stock price falling away and for volatility

Step 2: Price falls below the 40-Day Moving Average (MA)

Step 3: Relative Timing (RT) drops below 1.00

Step 4: REC = Sell

Please see the VectorVest Australia Blog for more detail on this: http://vectorvestcomau.azurewebsites.net/4-steps-to-protecting-profits-amp-dominos-pizza-and-bellamys/.

The blog post has 2 videos on applying this technique.

Final step now to managing your stocks applying the 4 Steps:

JIN.AX: You would still be in this stock (up over 118%)

ANO.AX: You would still be in this stock (up over 250%)

APX.AX: You would still be in this stock (up over 80%)

SAR.AX: 4 Steps met at $2.69 for a loss of 9.43%

NST.AX: 4 Steps met at $8.05 for a loss of 13.53%

SSM.AX: You would still be in this stock (Up over 30%)

PME.AX: You would still be in this stock (up over 45%)

Notice per the above list, none of these stocks were penny stocks. All these stocks had good volume except ANO.AX which was averaging around 30,000 trades a day back on 9 January this year and, as a result, may have been dismissed.

One last thing, if you are more conservative in terms of your earnings profile and you want at least 5 years of consistent earnings, you may have built a WatchList per the list discussed back on 11 January this year (see the VectorVest views on 11 January 2019 for further details). That being: ALL.AX, CTD.AX, MFG.AX and WEB.AX. None of these stocks have met Dr. DiLiddo’s 4 Steps to Protecting Profits just yet… with over 24% returns currently on these stocks.

Leave A Comment