IT’S BACK TO BUSINESS FOR THE SMSF BALANCED PORTFOLIO.

Written by: Robert and Russell Markham

Per our Confirmed Down, C/Dn, signal on 13 September 2018 through to the Confirmed Up, C/Up on 9 January 2019, the market went through a steep correction by historical standards. VectorVest kept you on the right side of the market for that period.

I was having a look through the portfolios (per the VectorVest Portfolios tab) that we track to see how these portfolios have held up in recent weeks. All the Model Portfolios use strict risk and money management rules and have been BackTested over several years. Overall, I would note that the portfolios have held up well considering the market in recent weeks. There has been a bit of drawdown in some, but note the rapid turnaround taking place. And that is what it is all about, minimising losses in the down market periods and capitalising on the upward momentum in the up market periods, and most importantly, sticking to your trading plan.

One portfolio that really jumped out at me was the SMSF Balanced Portfolio. Robert Markham designed this portfolio back in 2012 and it has barely missed a beat since. Currently, this portfolio is hitting a new all-time high, surpassing the value back in August last year before the market fell away from September through early January.

The most recent acquisitions into the SMSF Balanced portfolio are:

GEM.AX – bought on 4 January 2019, up over 20%

VRL.AX – bought on 4 January 2019, up over 10%

FMG.AX – bought 7 November 2018, up over 40%

If you had setup the SMSF Balanced Portfolio to send you alerts, you would have got all these alerts. The alerts tell you the day before going into the market, where the portfolio acquires all the given stocks on the market open.

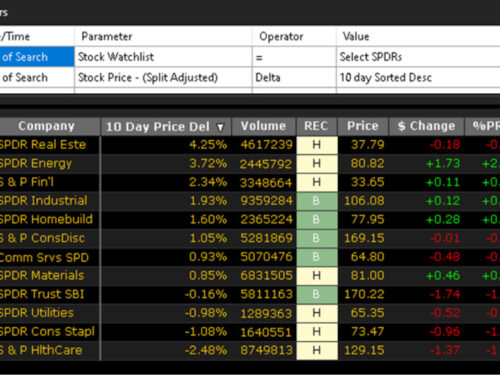

One of the driving forces behind the SMSF Balanced Portfolio is the search being applied. The SMSF Balanced Portfolio makes use of the search: Southern Comfort SC Div. (as found under the Searches – Precision Trading Group). This search is looking for mid-cap type stocks, exhibiting strong sustainable momentum. The real power of this search is in the sort: RT * VST * CI / Price. The sort ensures the best shares with momentum (RT), Fundamentals, Safety and Timing (VST) and resilience (CI) are found on a dollar by dollar basis.

The key to this portfolio is that it is not just going to find these stocks at any point in time. These stocks will only be selected in a rising market, where the portfolio makes use of the GLB/RT Kicker Market Timing signal (a slightly more aggressive Market Timing signal to our Confirmed Calls, but still makes use of the C/Dn call for the exit signal).

The SMSF Balanced Portfolio provides plenty of breathing space by applying a 20% Trailing Stop loss. BackTesting has proven over the years that a wider ranging stop-loss works with these parameters and the shares it chooses.

If you click on the Portfolios tab and then click on Portfolio Performance (per the bottom left). The report that is loaded up notes that the SMSF Balanced Portfolio has annualised over 50% a year, with 66% winning trades and a drawdown of only 17.05% for the last 8 years.

The SMSF Balanced Portfolio has got off to a very strong start in 2019.

Leave A Comment